How to use trading features on BingX

Table of contents:

Part 1: How to get started with spot trading

Part 2: How to purchase crypto via P2P on BingX

Part 3: How to get started with future trading

Part 4: How to get started with copy trading

Part 5: How to get started with grid trading

Part 1: How to get started with spot trading

1. What is spot trading

Spot trading refers to the direct trading of cryptocurrencies, where investors can buy cryptocurrencies in the spot market and profit from their appreciation.

2. What order types does spot trading support

Market order: Investors buy or sell cryptocurrencies at the current market price.

Limit order: Investors buy or sell cryptocurrencies at a preset price.

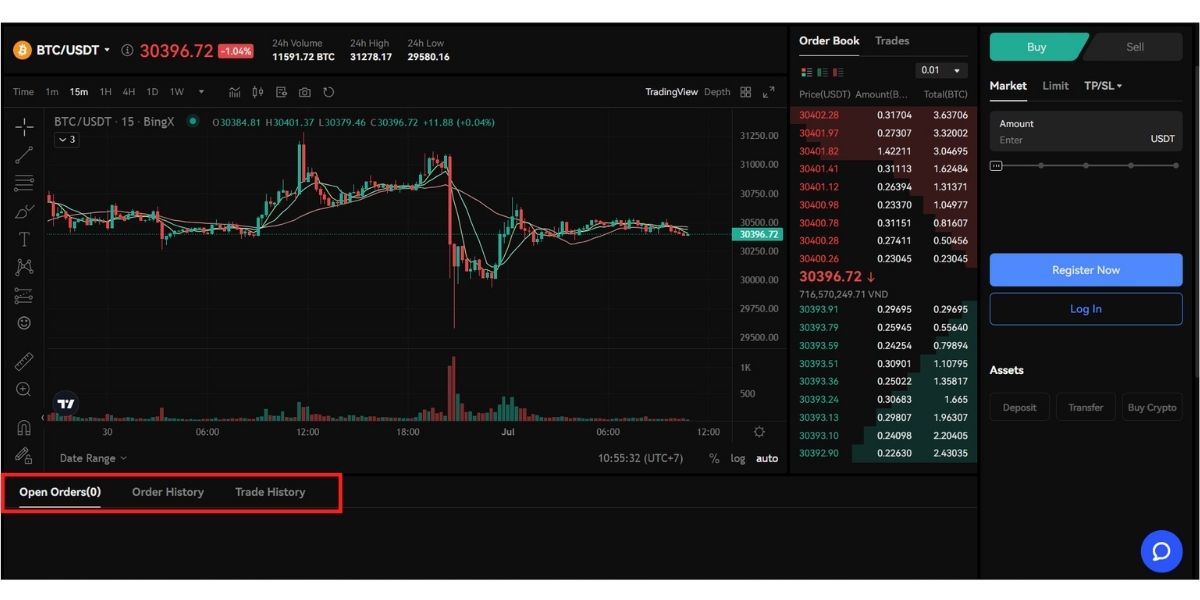

3. How to trade spot on BingX

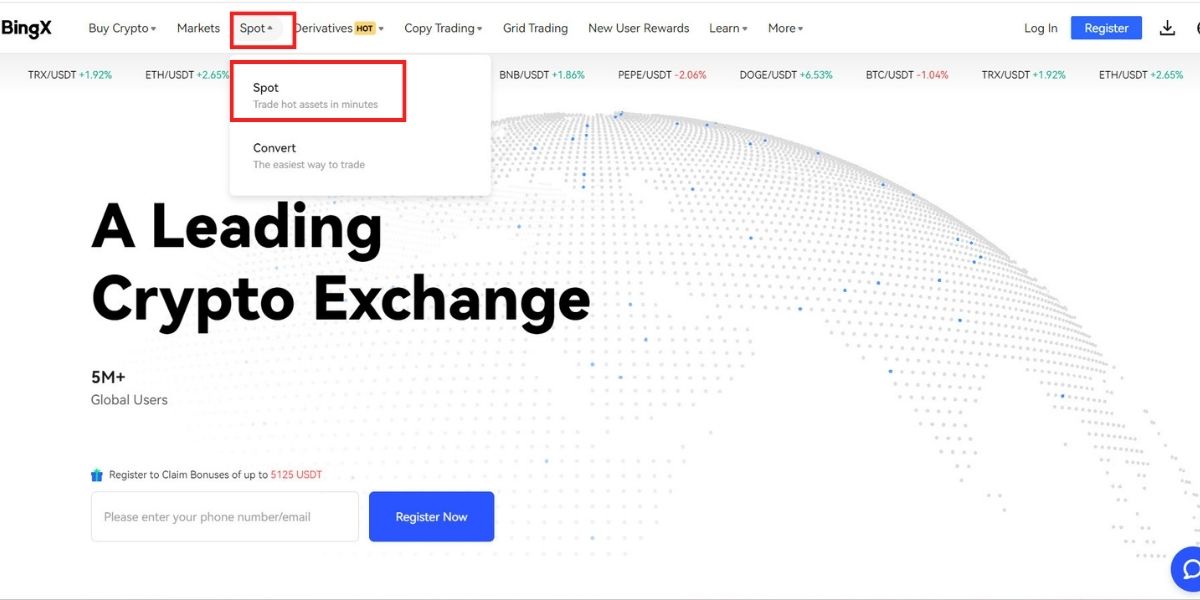

Step 1: Enter the trading page. Web: Homepage – Spot – Spot; App: Homepage – Spot – Spot.

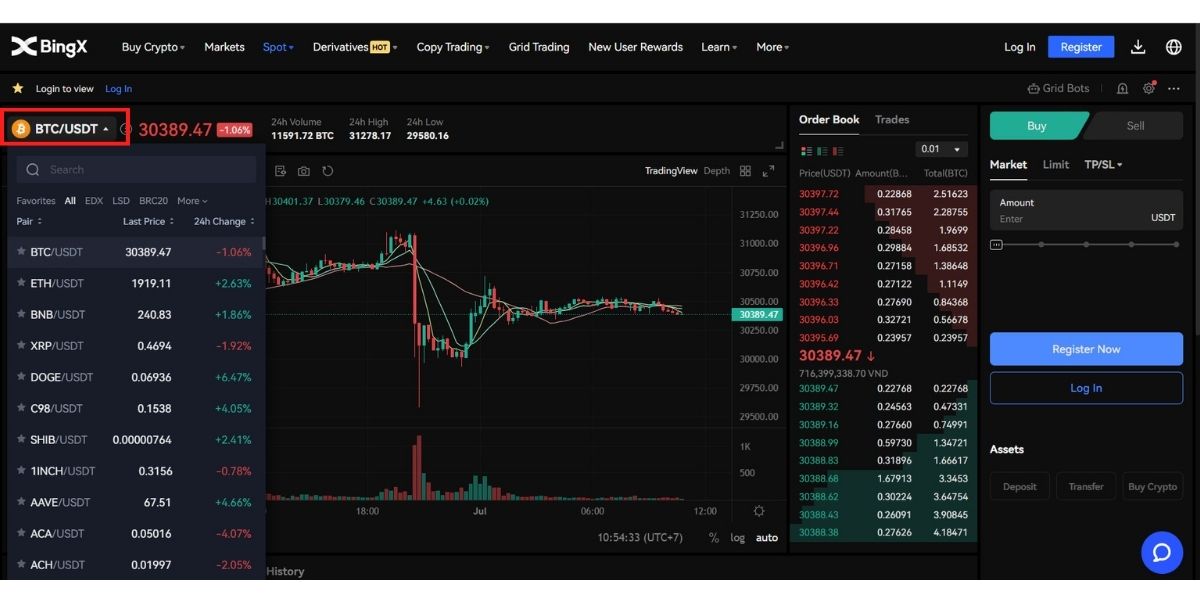

Step 2: Select a trading pair or enter your preferred trading pair in the search bar, e.g., BTC/USDT.

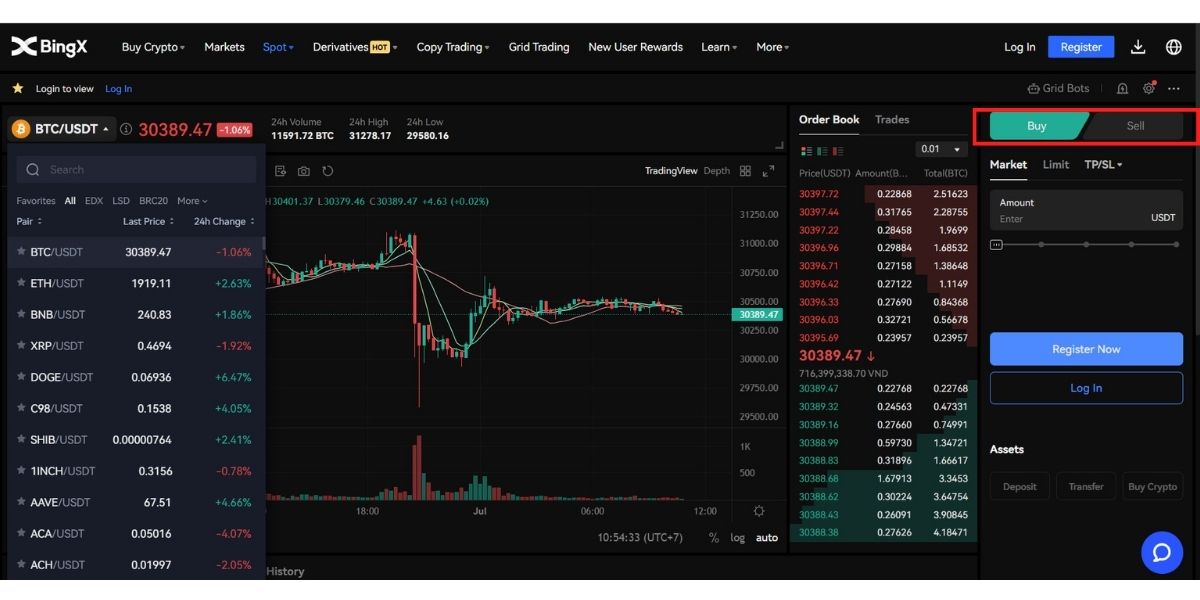

Step 2: Select a trading pair or enter your preferred trading pair in the search bar, e.g., BTC/USDT. Step 3: Choose transacton direction: Buy or Sell.

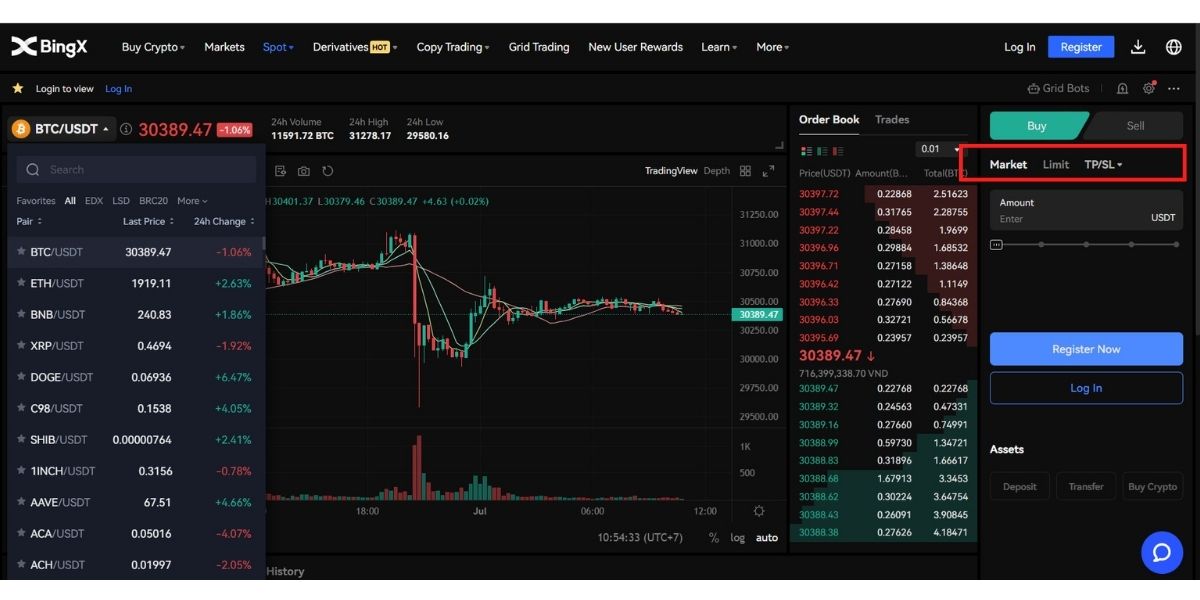

Step 3: Choose transacton direction: Buy or Sell. Step 4: Choose an order type: Market Order or Limit Order.

Step 4: Choose an order type: Market Order or Limit Order.

Step 5:

- For “Market Order”, set an “Amount” and click the “Buy” button below to place the order.

- For “Limit”, set the “Price” and input an “Amount” or “Quantity” that you would like to buy, then click the “Buy” button below to make the order.

Step 6: After the order is placed, go to “Open Orders” or “Order History” to view order details. You can click “Cancel” to cancel the order before the order is filled.

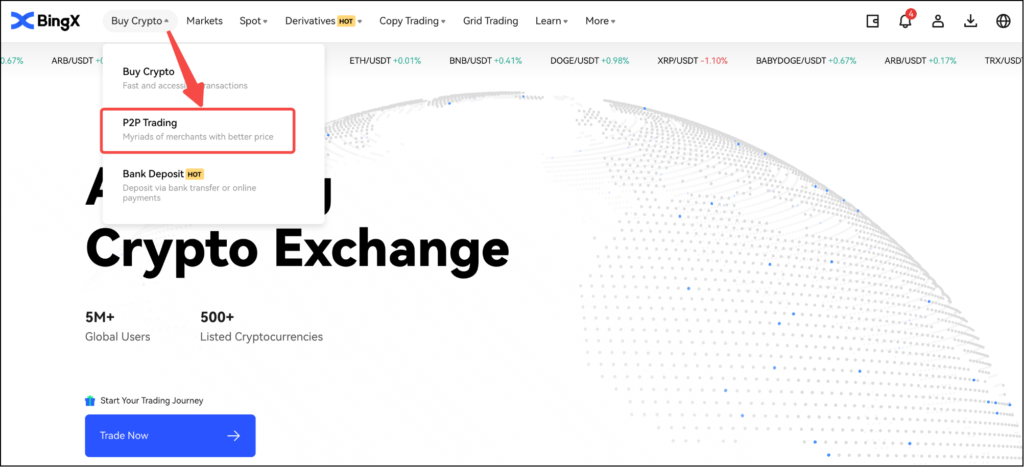

Part 2: How to Purchase Crypto via P2P on BingX

BingX currently offers 3 methods to purchase crypto with fiat currencies: P2P trading, Buy Crypto and Bank Deposit. P2P trading is available for global users, supports fund escrow during transactions, and is highly flexible. This article will walk you through how to buy crypto via P2P on the BingX official website and App.

If you are a new user who is buying crypto for the first time, you can do so under the “Buy” section of P2P Trading after completing KYC verification

Step 1: Log in to BingX’s official website. Click “Buy Crypto” on the homepage and select “P2P Trading”.

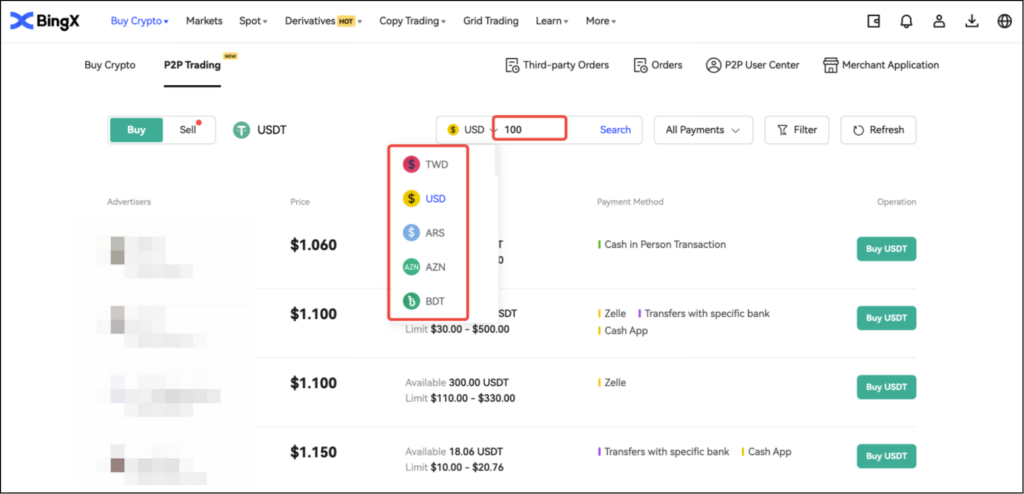

Step 2: Select a currency you would like to pay, enter a value and click “Search”. Select a seller from the search results below and click “Buy USDT”.

Step 2: Select a currency you would like to pay, enter a value and click “Search”. Select a seller from the search results below and click “Buy USDT”.

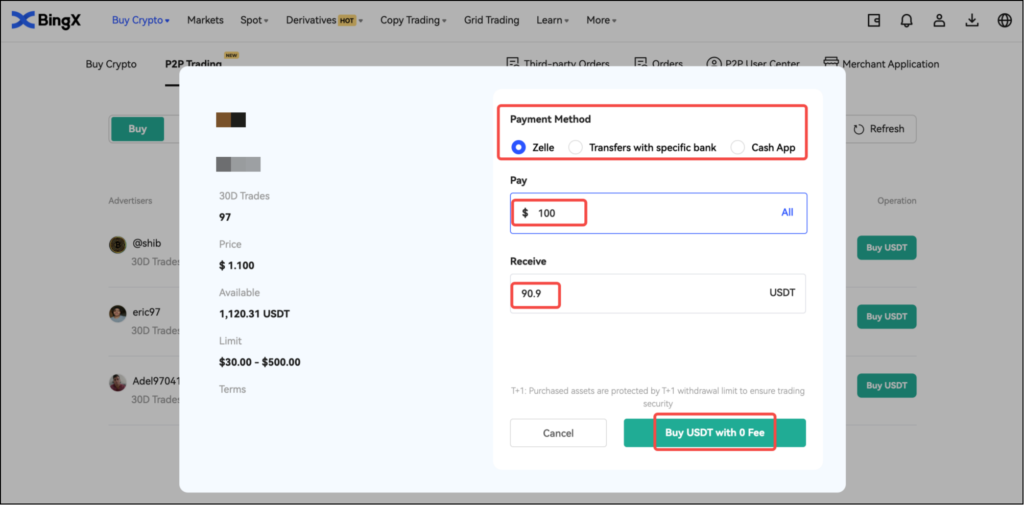

Step 3: Choose a payment method and enter the value you would like to pay. The platform will auto-generate the amount of crypto you will receive based on the current exchange rate. After that, click “Buy”. You can then contact the seller for payment information and complete the payment on the third-party platform.

Step 3: Choose a payment method and enter the value you would like to pay. The platform will auto-generate the amount of crypto you will receive based on the current exchange rate. After that, click “Buy”. You can then contact the seller for payment information and complete the payment on the third-party platform.

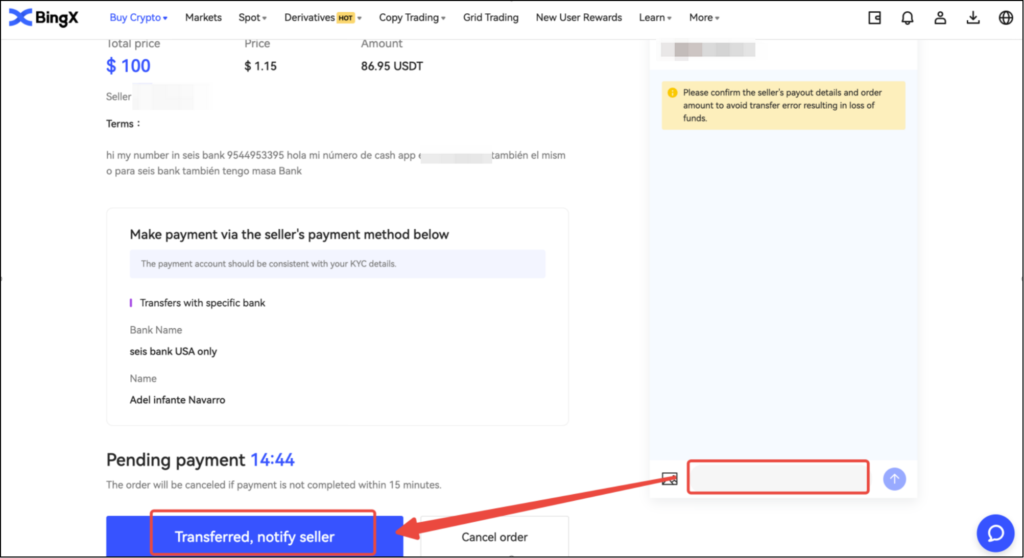

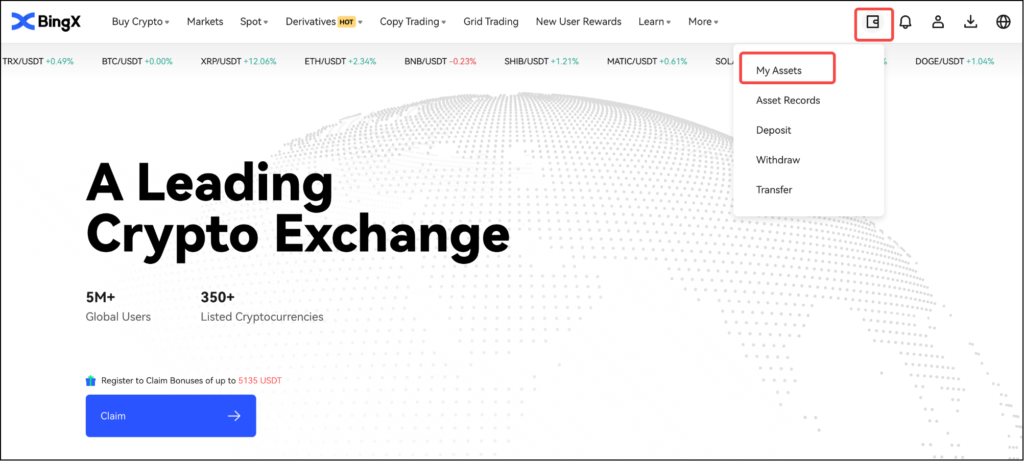

Step 4: Once the payment is completed, click “Transferred, notify seller” on the order page. After the seller confirms the receipt of your payment and releases the crypto, the purchase is thus completed. Make the payment and you’ll receive the crypto. You can check it by clicking “My Assets” on the BingX homepage.

Part 3: How to get started with future trading

1. What is Futures

Futures is a derivatives product for hedging risks and amplifying returns via using leverage. In futures trading, you can long or short a trading pair to take advantage of and profit from the price volatility.

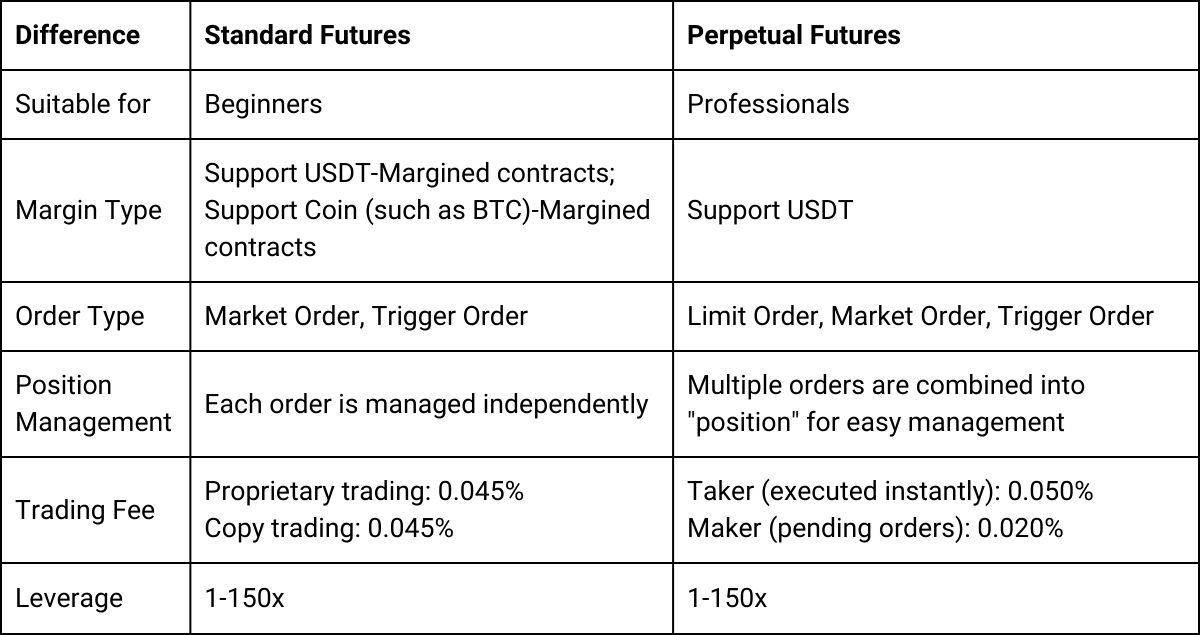

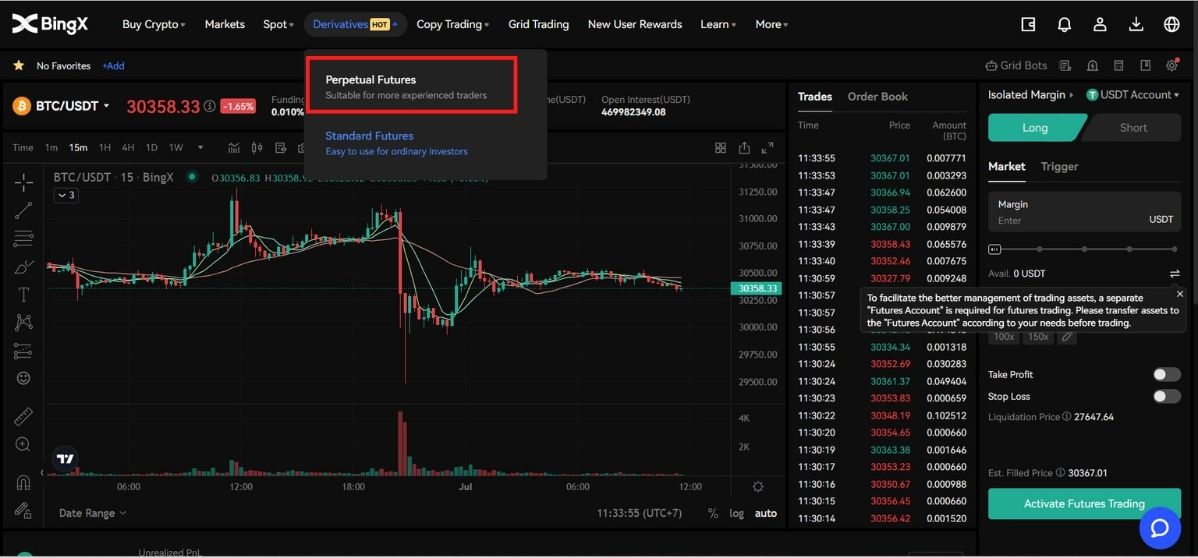

2. Differences between BingX Standard Futures and Perpetual Futures

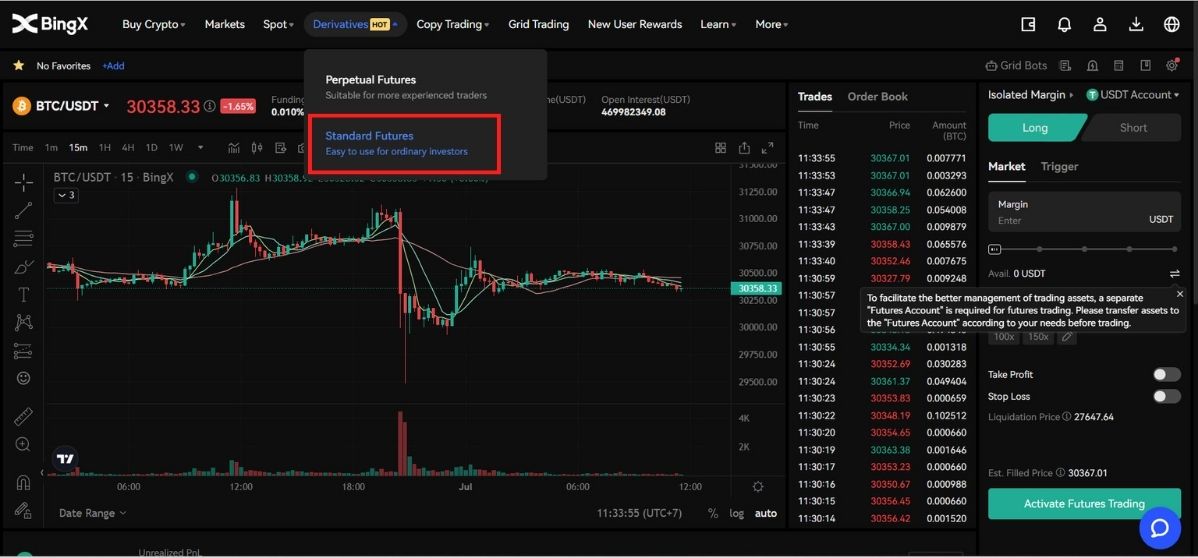

3. How to trade futures contracts

BingX futures trading platform allows you to draw on leverage while going long or short to hedge risks or make money in a volatile market. Get started with futures trading on BingX by taking the following steps.

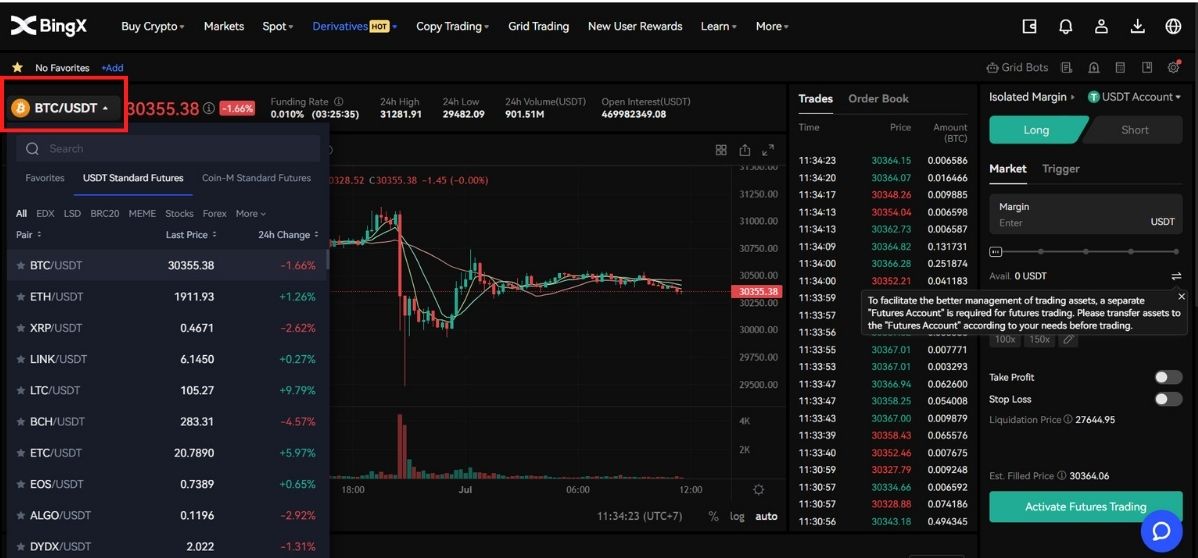

3.1 Standard Futures

Step 1: Select a trading pair, e.g., BTC/USDT

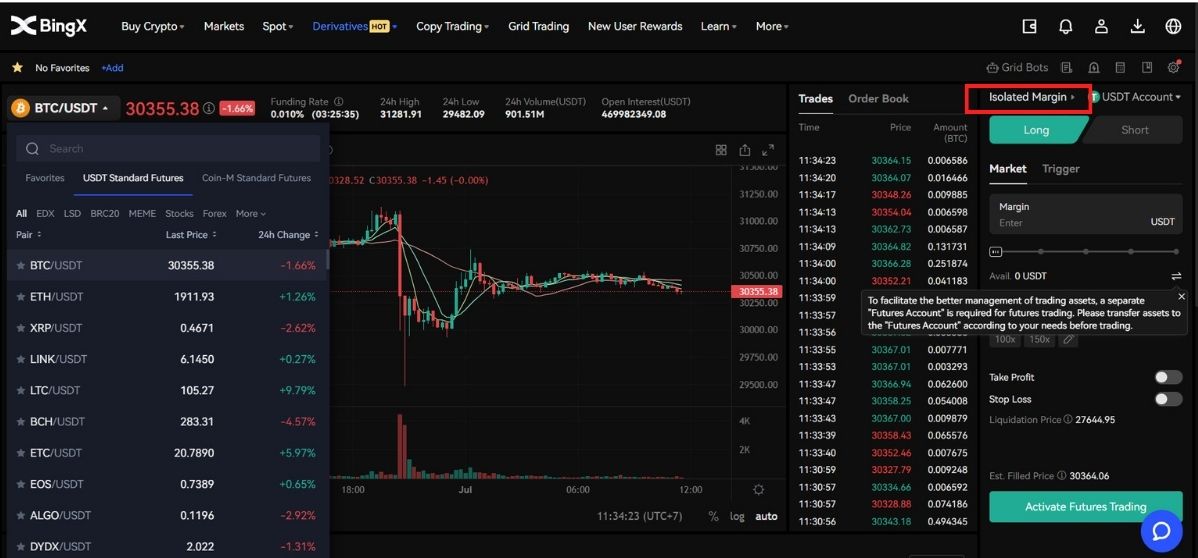

Step 2: Select a margin mode, e.g., “Isolated Margin” or “Cross Margin”

Step 2: Select a margin mode, e.g., “Isolated Margin” or “Cross Margin”

Step 3: Select a direction, e.g., “Long” or “Short”

Step 3: Select a direction, e.g., “Long” or “Short”

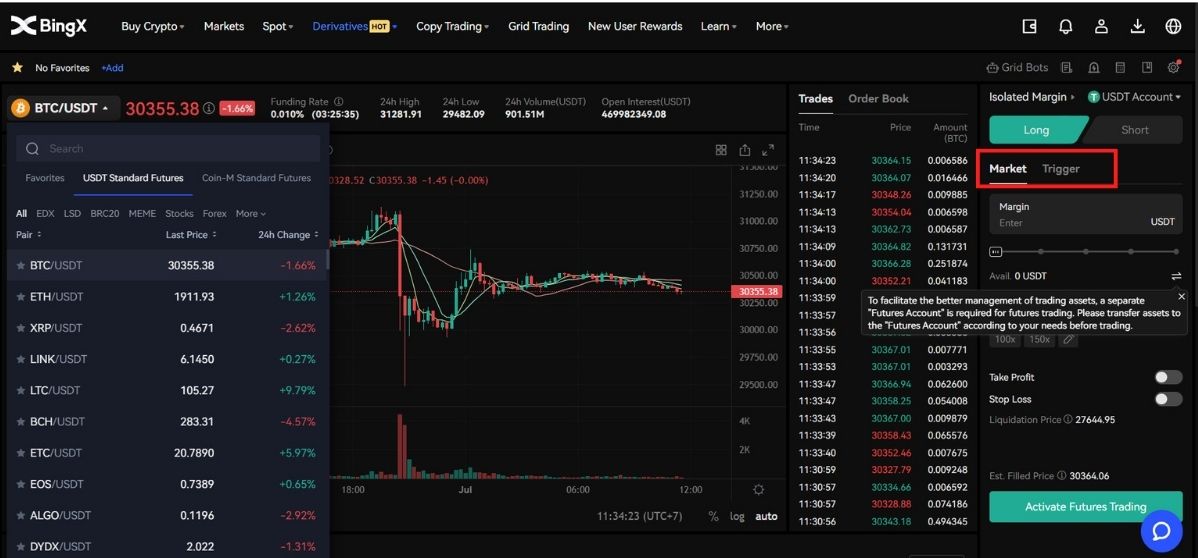

Step 4: Select an order type, e.g., “Market Order” or “Trigger Order”

Step 4: Select an order type, e.g., “Market Order” or “Trigger Order”

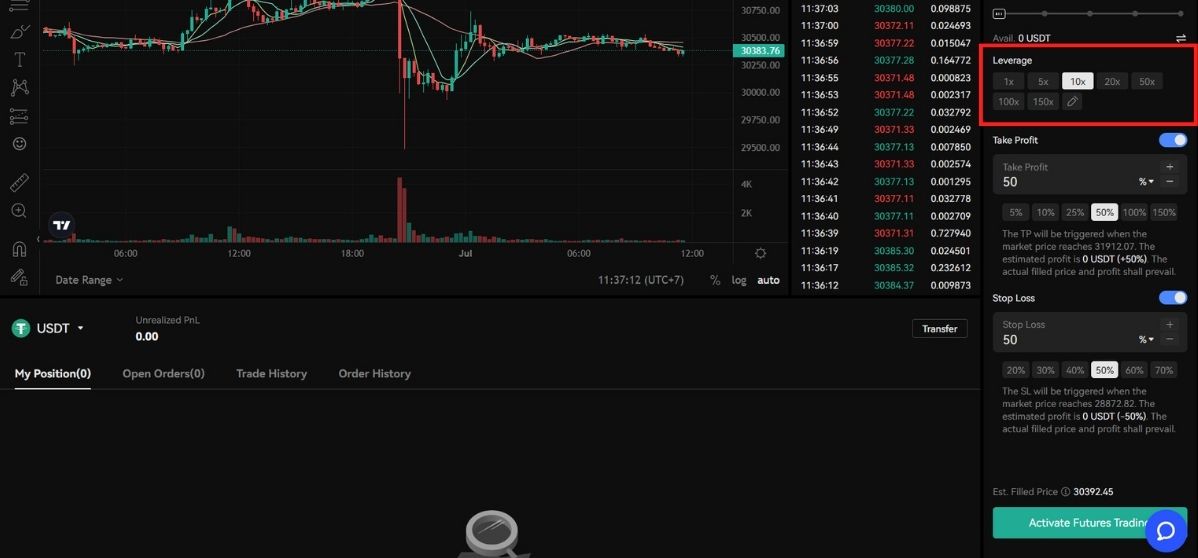

Step 5: Set up the leverage. Please read carefully the Margin Trading Risk Disclosure when applying high leverage

Step 5: Set up the leverage. Please read carefully the Margin Trading Risk Disclosure when applying high leverage

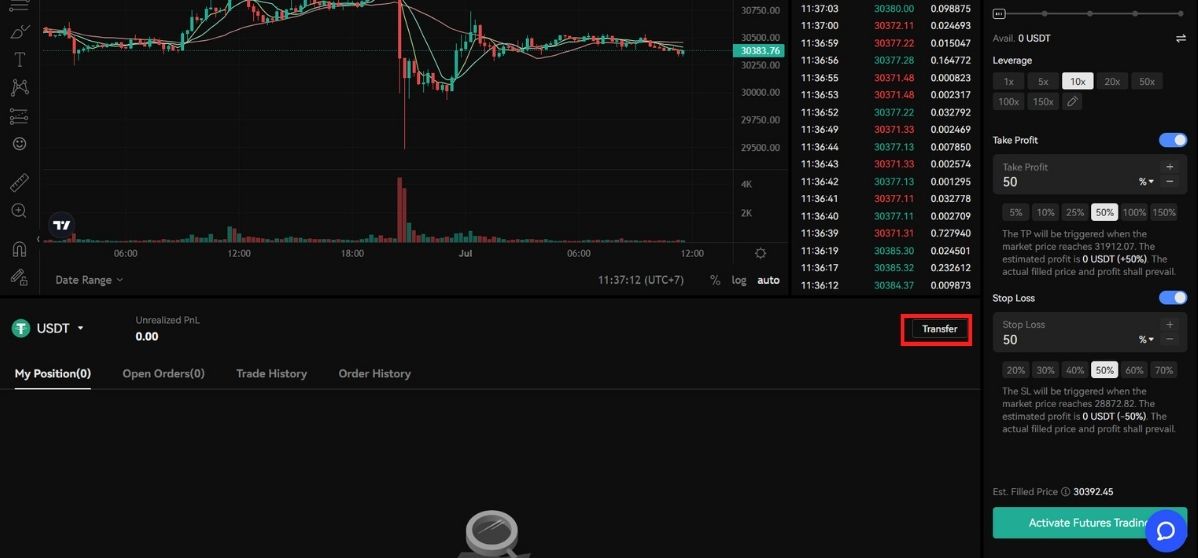

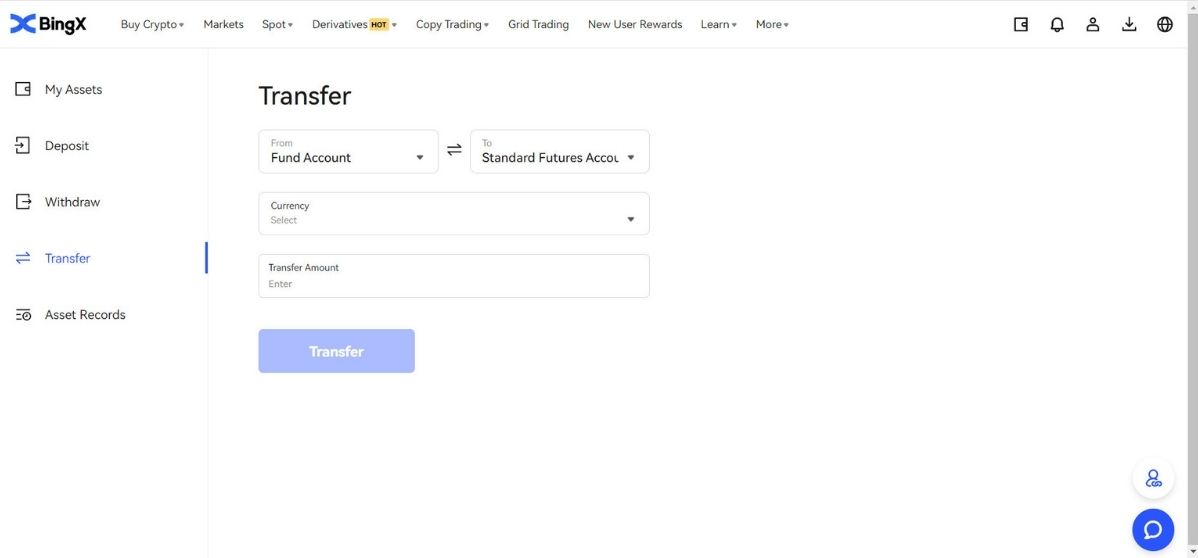

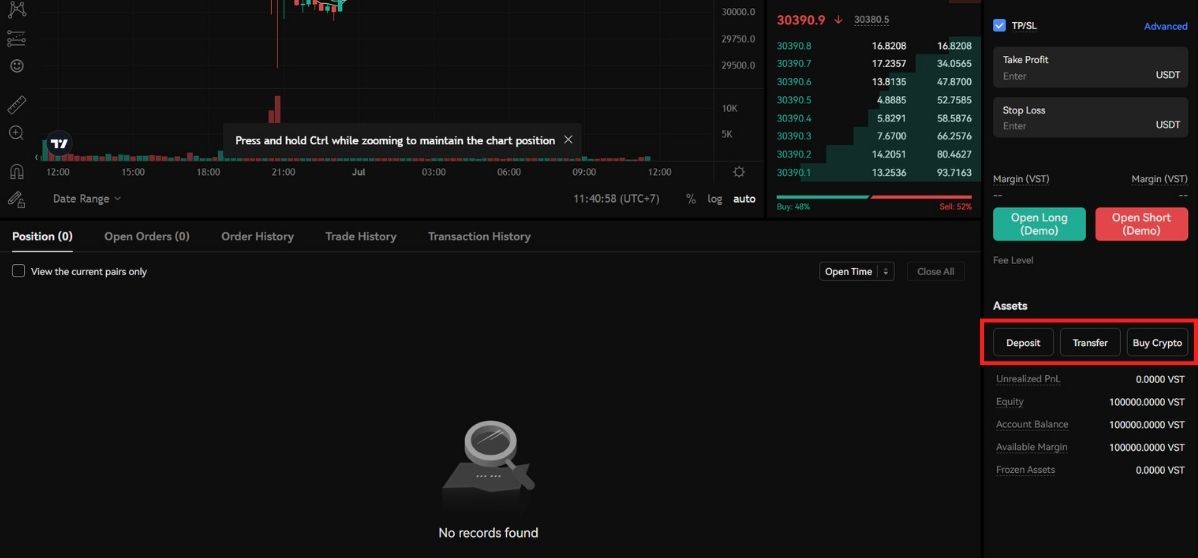

Step 6: Transfer USDT or the underlying asset (such as BTC, ETH) from your fund account to the Standard Futures account as margin and enter the margin amount

Step 6: Transfer USDT or the underlying asset (such as BTC, ETH) from your fund account to the Standard Futures account as margin and enter the margin amount

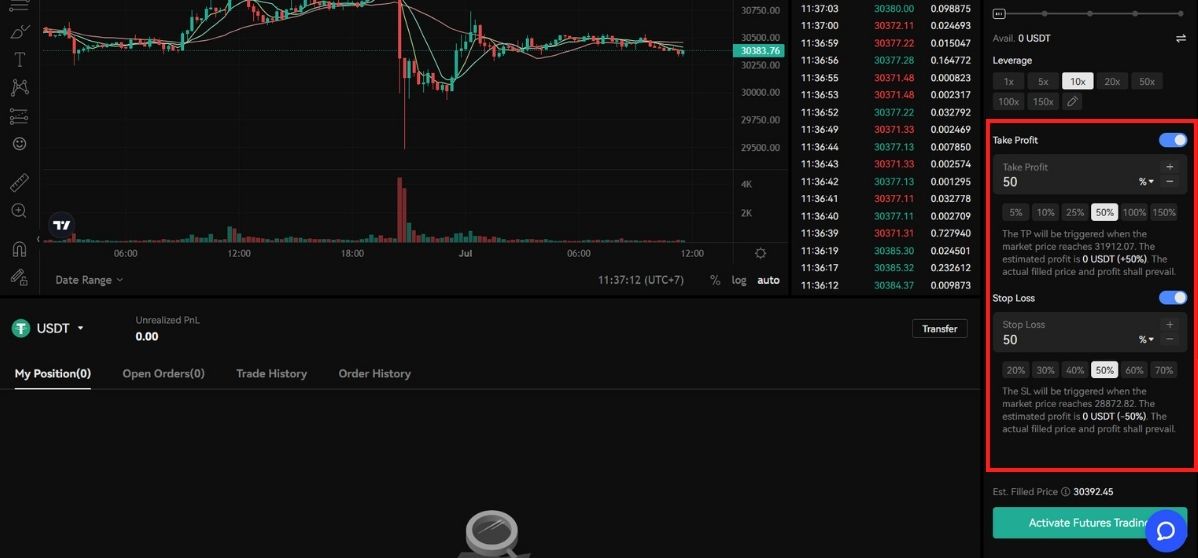

Step 7: Click Advanced Settings to set up TP/SL

Step 7: Click Advanced Settings to set up TP/SL

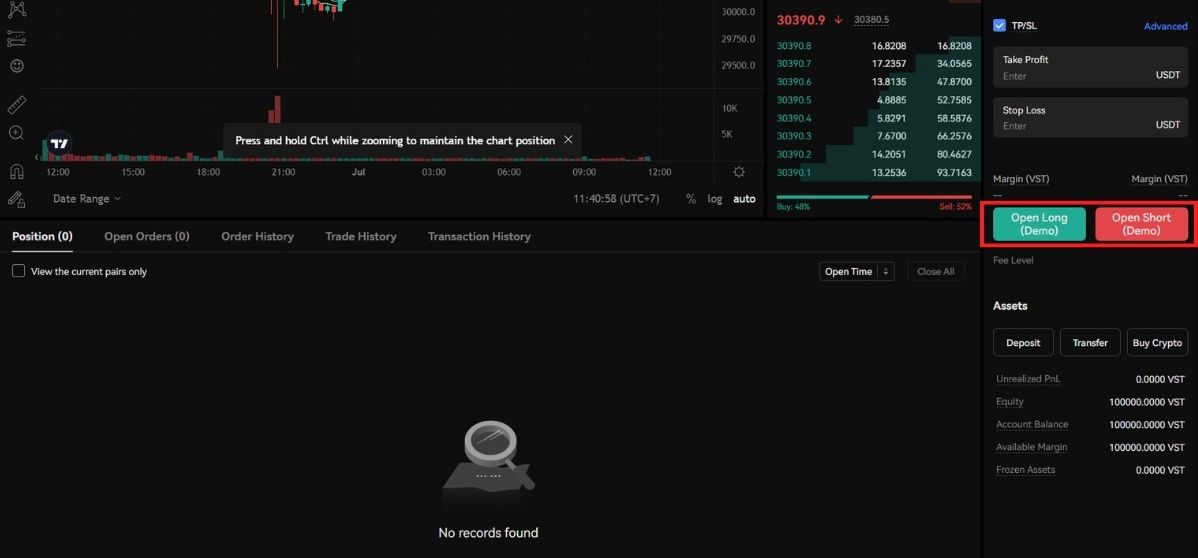

Step 8: Click “Long” or “Short” to place an order

Step 8: Click “Long” or “Short” to place an order

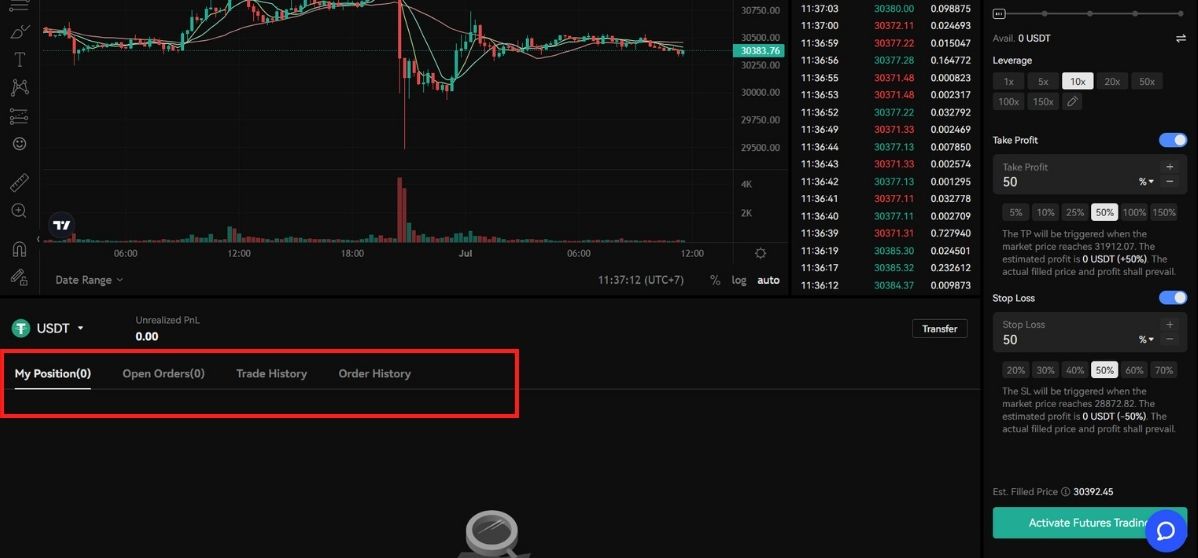

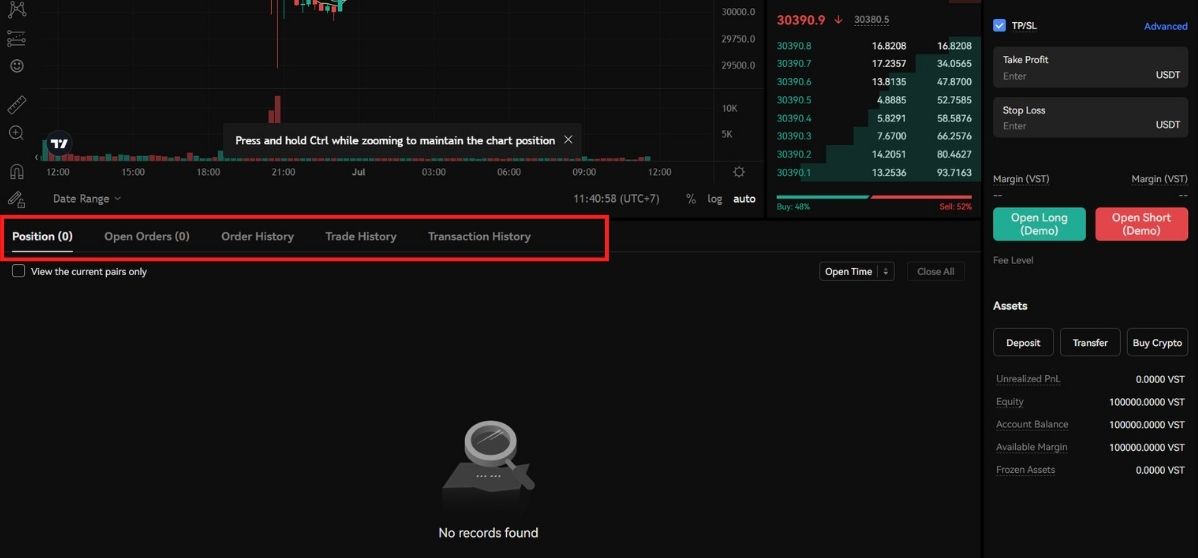

Step 9: Tap on “Orders” to view details of the order you just placed

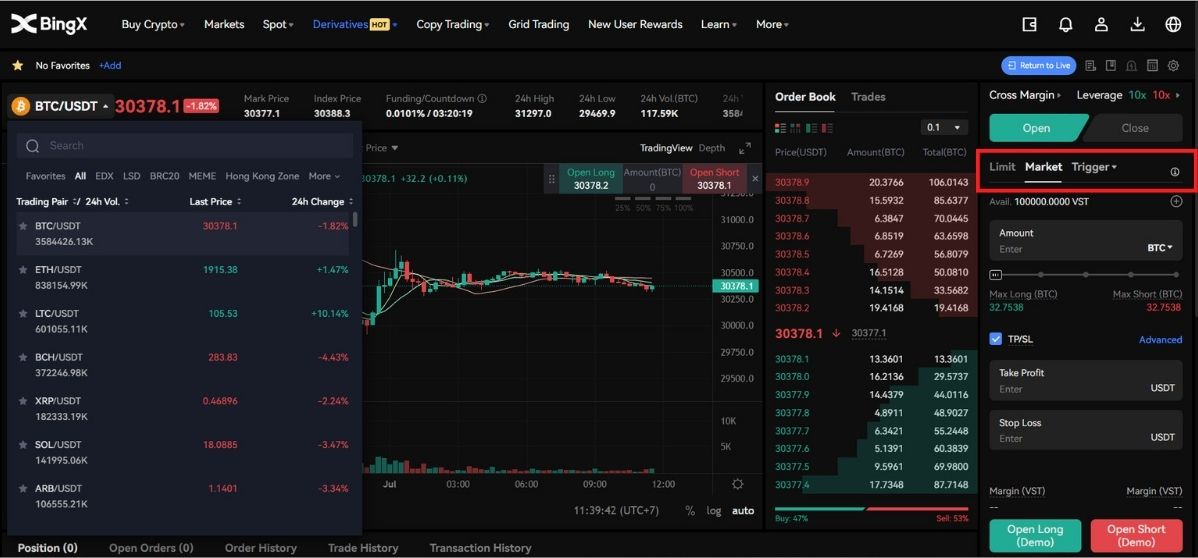

3.2 Perpetual Futures

Step 1: Select a trading pair, e.g., BTC/USDT

Step 2: Select a margin mode, e.g., “Isolated Margin” or “Cross Margin”

Step 2: Select a margin mode, e.g., “Isolated Margin” or “Cross Margin”

Step 3: Select a direction, e.g., “Long” or “Short”

Step 3: Select a direction, e.g., “Long” or “Short”

Step 4: Select an order type, e.g., “Market Order”, “Trigger Order” or “Limit Order”

Step 4: Select an order type, e.g., “Market Order”, “Trigger Order” or “Limit Order”

Step 5: Set up the leverage. Please read carefully the Margin Trading Risk Disclosure when applying high leverage

Step 5: Set up the leverage. Please read carefully the Margin Trading Risk Disclosure when applying high leverage

Step 6: Set up Rival Price and TP/SL

Step 6: Set up Rival Price and TP/SL

Step 7: Transfer USDT from your fund account to the Standard Futures account as margin and enter the margin amount

Step 7: Transfer USDT from your fund account to the Standard Futures account as margin and enter the margin amount

Step 8: Click “Buy/Long” or “Sell/Short” to place an order

Step 8: Click “Buy/Long” or “Sell/Short” to place an order

Step 9: Tap on “Orders” to view details of the order you just placed

Step 9: Tap on “Orders” to view details of the order you just placed

Part 4: How to get started with copy trading

1. What is copy trading

Copy trading is a feature that allows copiers to copy the trades of multiple elite traders by automatically aligning with traders’ trading activities and thus generating profits or losses. Copy trading saves users from the trouble of opening and closing positions and monitoring the market for themselves as all trades of the trader that they copy will be automatically copied.

2. Types of copy trading

2.1 Copy by position ratio

“Copy by position ratio” is a one-of-its-kind feature globally that is pioneered and recommended by BingX to safeguard copiers’ interests in the best possible way. The fund that users invest in “copy by position ratio” will only adjust with the position of the copy trading account they copy. By copying the trading signals and the trader’s real position ratio, copiers can achieve an ROI approximate to that of the copy trading account. “Copy by position ratio” does not allow copiers to perform autonomous trading.

E.g., if the copy trading account has a net asset of 1,000 USDT and uses 30% of the fund, i.e., 300 USDT, with 5x leverage to buy long BTC/USDT, the copiers will also use 30% of their fund (suppose 100 USDT), that is, 30 USDT with 5x leverage to buy long BTC/USDT.

2.2 Copy by fixed margin

“Copy by fixed margin” is limited to copying the trader’s BingX Standard Futures account and only copies the signals of trades opened in the isolated margin mode. This type allows copiers to perform autonomous trading.

E.g., if the copier sets 10 USDT as the margin for a single copy order and the trader buys long BTC/USDT, the system will buy long BTC/USDT for the copier with a 10 USDT margin regardless of the margin/position ratio of the trader. And the trade will be displayed in the Position of the copier’s USDT-M Standard Futures account.

2.3. Copy by spot grid

“Copy by spot grid” is limited to copying orders of the trader’ BingX Spot Grid Trading account.

E.g., if the copier invests 1,000 USDT in “copy by spot grid”, it will copy the grid parameters of the trader’s strategy and subsequently create a spot grid order which will be displayed in the order history of Grid Trading. “Copy by spot grid” allows copiers to cancel the spot grid trading strategy at their own discretion.

3. How to start copy trading

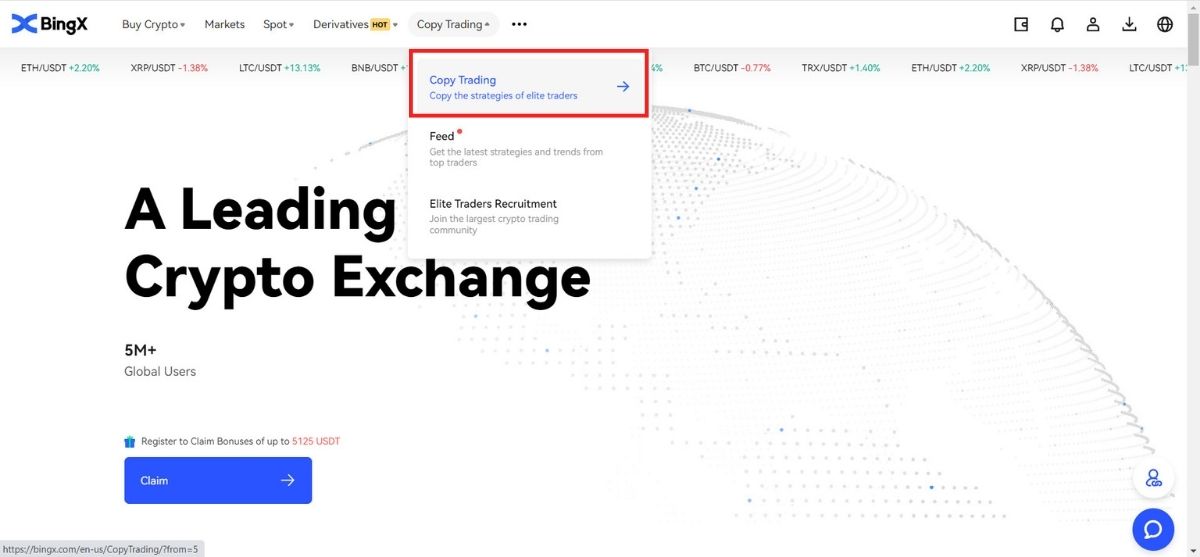

Step 1: Access Copy Trading. Homepage -> Copy Trading.

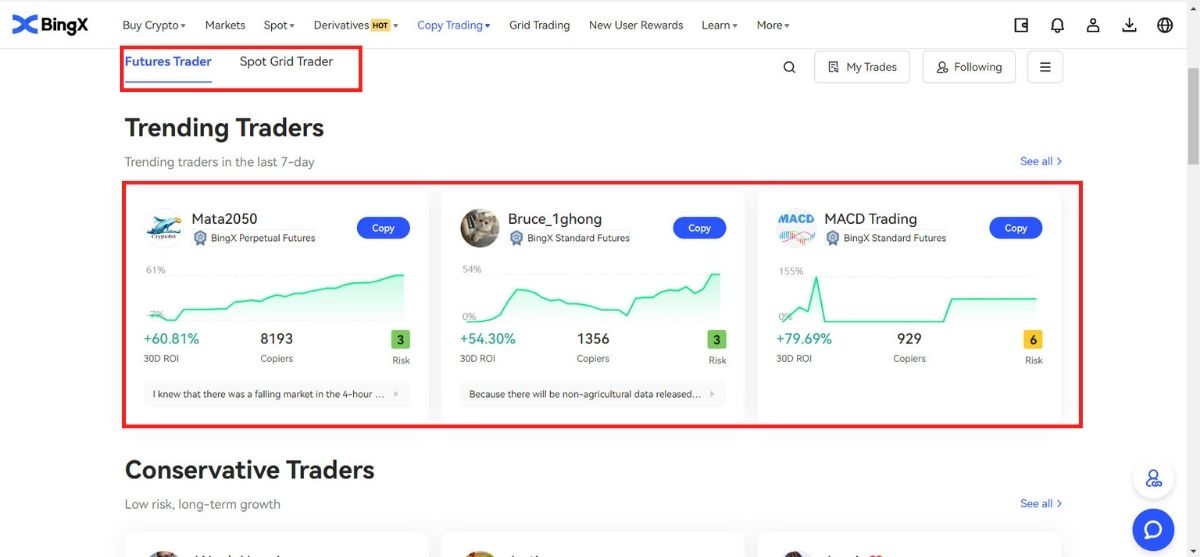

Step 2: Select a trader. You can select from “Trending Trader” or “Conservative Trader” recommended by the system based on their past data. Click their avatar to view their “Share Trading Data” or “Feed”. For any questions about any indicator, click the indicator to see Data Indicator Definition.

Step 2: Select a trader. You can select from “Trending Trader” or “Conservative Trader” recommended by the system based on their past data. Click their avatar to view their “Share Trading Data” or “Feed”. For any questions about any indicator, click the indicator to see Data Indicator Definition.

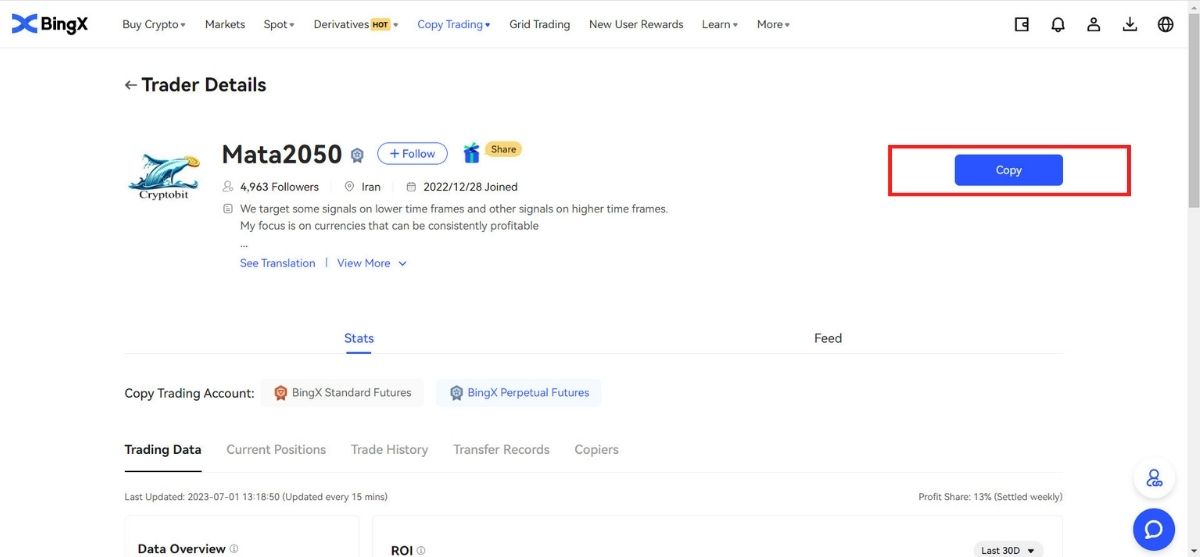

Step 3: On the trader’s homepage, click “Copy Now” and enter Copy Settings.

Step 3: On the trader’s homepage, click “Copy Now” and enter Copy Settings.

- Copy trading type: There are three types including copy by position ratio, copy by fixed margin, and copy by spot grid, depending on the share trading account that the trader uses.

- Principal type: USDT and VST (Virtual USDT) for copy trading under Standard Futures; USDT for copy trading under Binance Futures and BingX Spot Grid.

- Copy trading funds:

For copy trading with BingX Standard Futures, users can set “Principal of a Single Trade”, “TP/SL”, “Daily Copy Trading Principal” and “Max. Position Margin”.

For copy trading with Binance Futures, users can set “Copy Trading Funds”, “Copy trader’s positions immediately”, and”TP/SL”.

For copy trading with BingX Spot Grid, users can set “Trading Pair”, “Copy Trading Funds”, and “Copy Trader to Close Grid Parameters”.

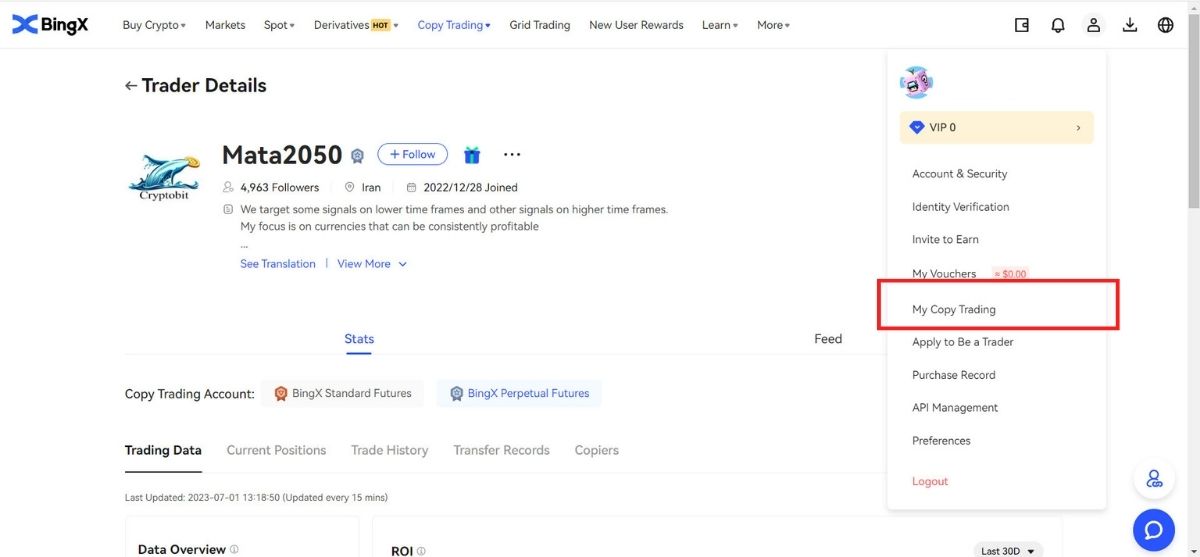

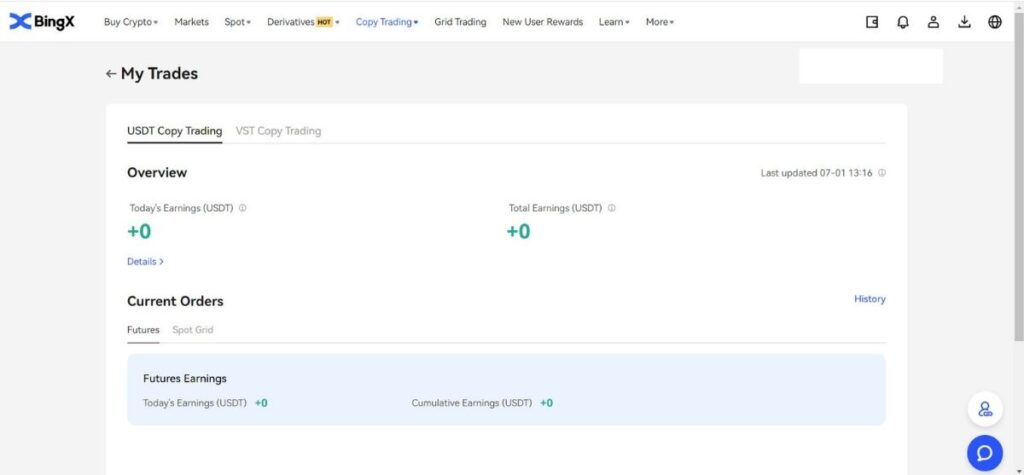

Step 4: Click “My Trades” to check copy trading data.

- Overview: It displays “Today’s Earnings” and “Total Revenue”. Click “Details” to view more data.

- Current: It Includes copy trading orders not closed yet.

- Copying History: It includes USDT and VST copy trading orders already closed.

Step 5: Edit or cancel copy trading orders.

Go to “My Trades” – “Current” and tap the trader you are copying. Click “Stop Copying” to stop copying manually. Once canceled, you will no longer copy the traders’ orders and the trader will no longer show on your copying list. Existing copied orders will be closed as the trader closes the orders. Click “Edit” to modify “Copy Settings”.

4. Position closing or deleveraging

4.1 Copy by fixed margin (Copy Trading with BingX Standard Futures)

4.2 Copy by position ratio (Copy Trading with BingX Perpetual Futures and Binance Futures)

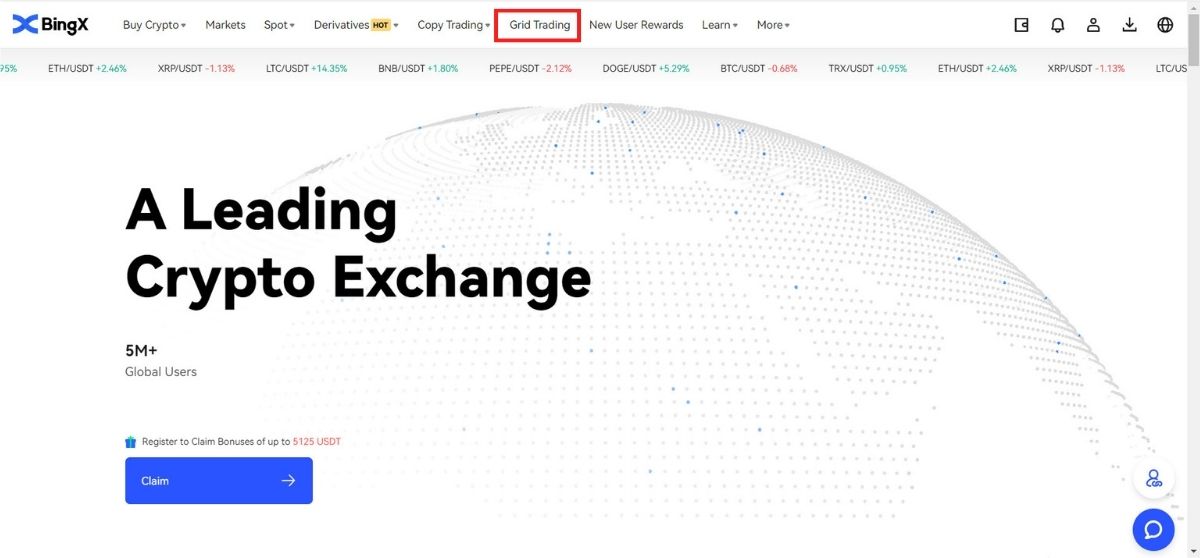

Part 5: How to get started with grid trading

1. What is grid trading

Grid trading is a type of quantitative trading strategy that automates buying and selling. It is designed to place orders in the market at preset intervals within a configured price range. To be more specific, grid trading is when orders are placed above and below a set price according to arithmetic or geometric mode, creating a grid of orders at incrementally increasing or decreasing prices. In this way, it constructs a trading grid that buys low and sells high to earn profits.

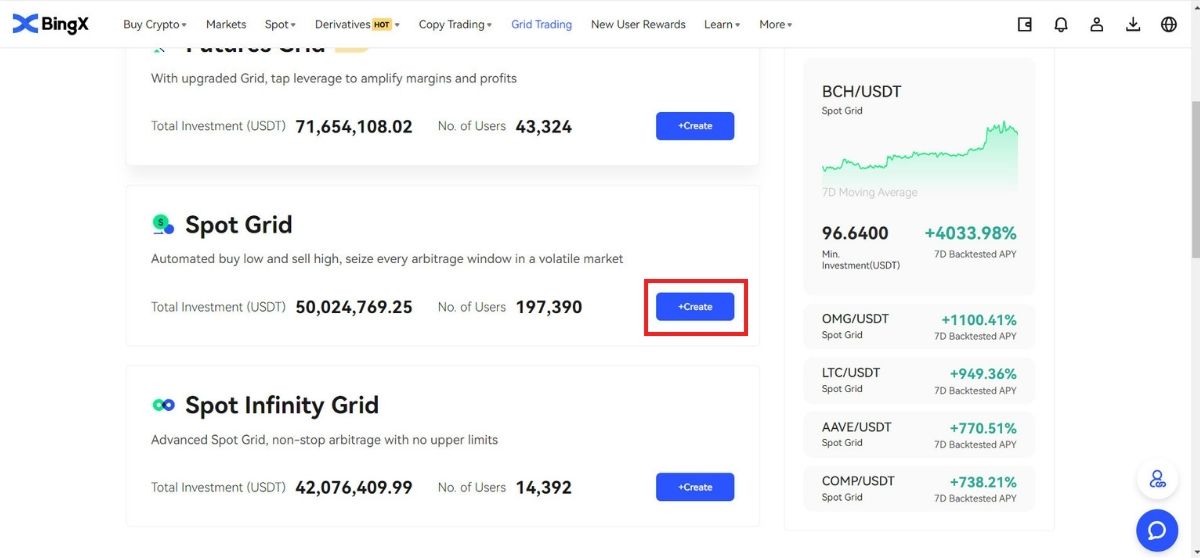

2. Types of grid trading

Spot Grid: Automatically buy low and sell high, seize every arbitrage window in a volatile market

Futures Grid: An advanced grid that allows users to tap leverage to amplify margins and profits

3. Get started with Spot Grid

Step 1: Homepage->Grid Trading->Spot Grid.

Step 2: Select “Spot Grid” and click “+Create”.

Step 2: Select “Spot Grid” and click “+Create”.

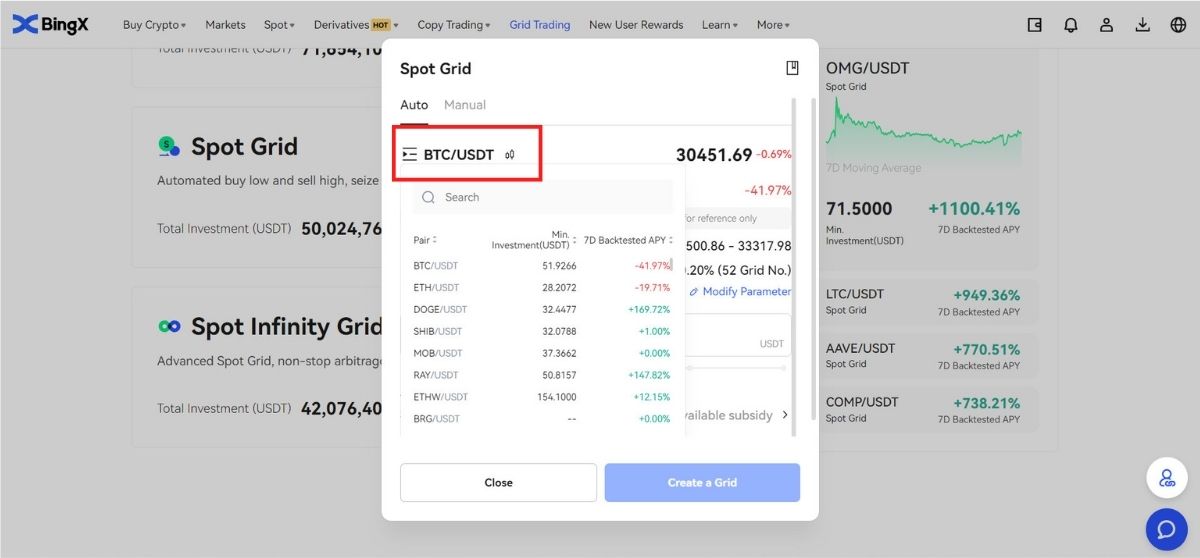

Step 3: Select a desired trading pair, such as BTC/USDT.

Step 3: Select a desired trading pair, such as BTC/USDT.

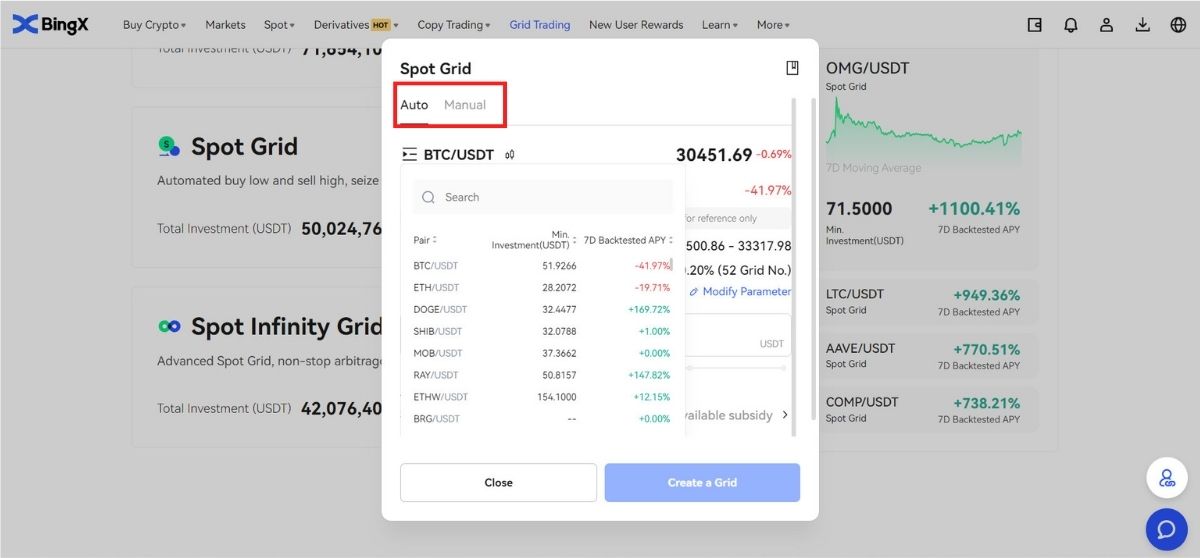

Step 4: Set up grid parameters. You can choose “Auto” or “Manual” to create a grid.

Step 4: Set up grid parameters. You can choose “Auto” or “Manual” to create a grid.

- Auto: The estimated best parameters that the system derives based on historical data and can be used directly.

- Manual: Users need to determine the price range and grid number based on their own judgment of the market volatility.

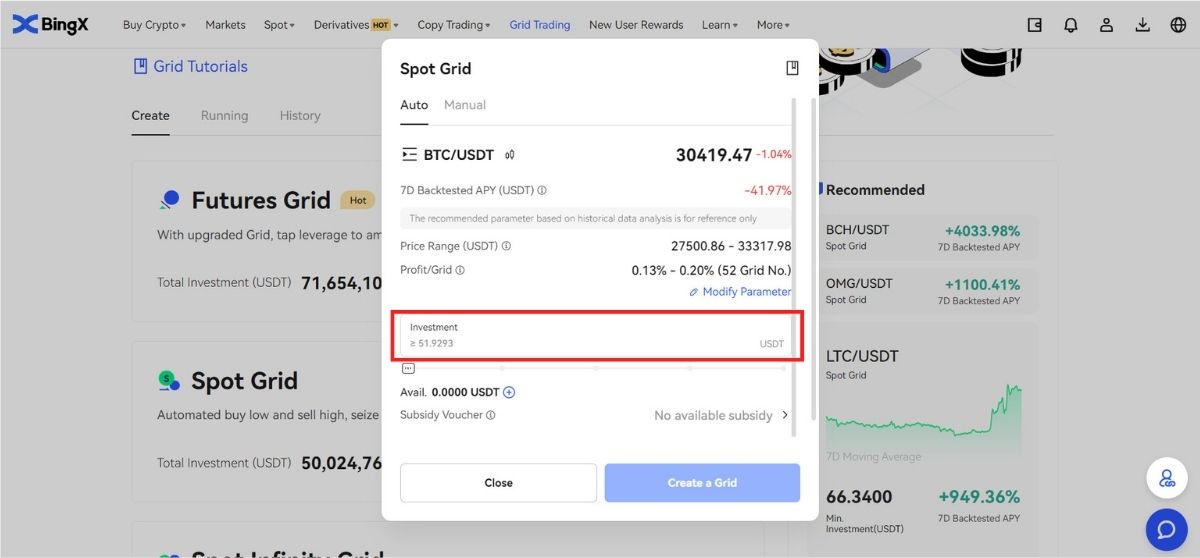

Step 5: Set up the total investment

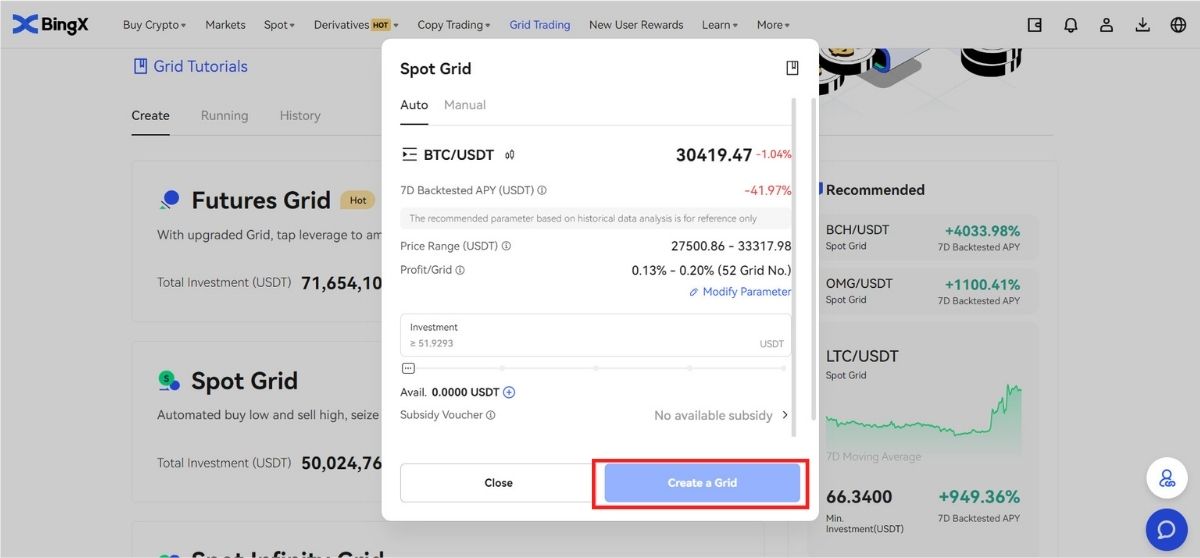

Step 6: Create a grid ✅

Step 6: Create a grid ✅

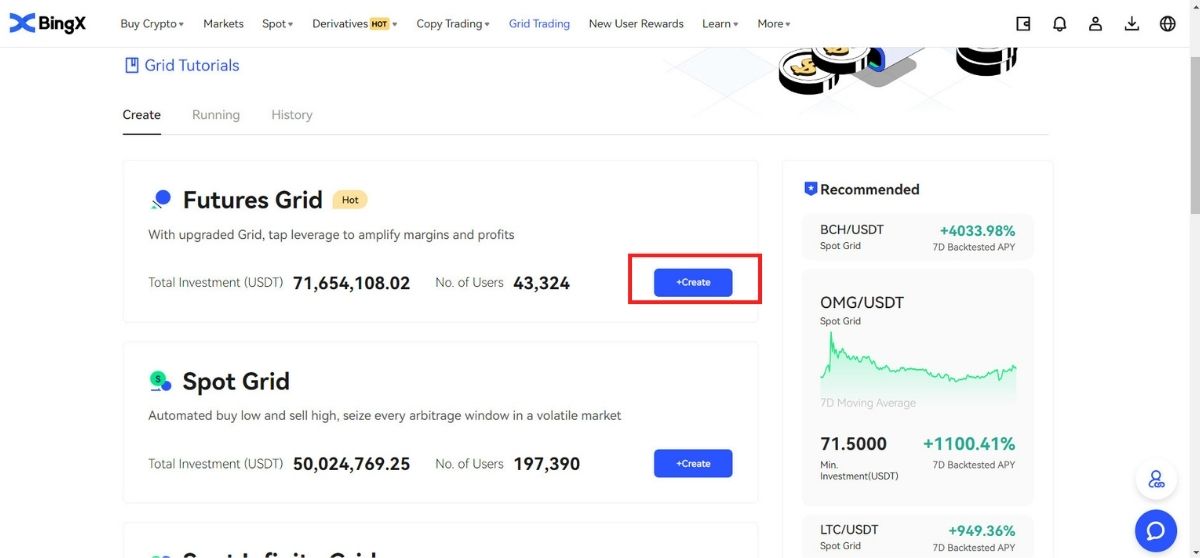

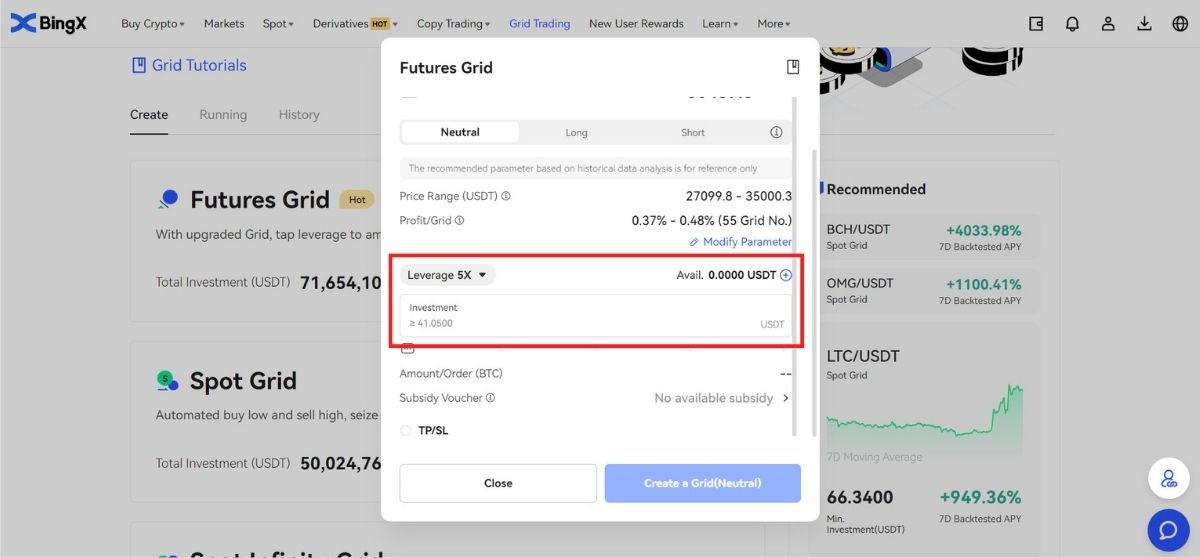

4. Get started with Futures Grid

Step 1:Homepage->Grid Trading->Futures Grid.

Step 2: Click “Futures Grid” and then “+Create”.

Step 2: Click “Futures Grid” and then “+Create”.

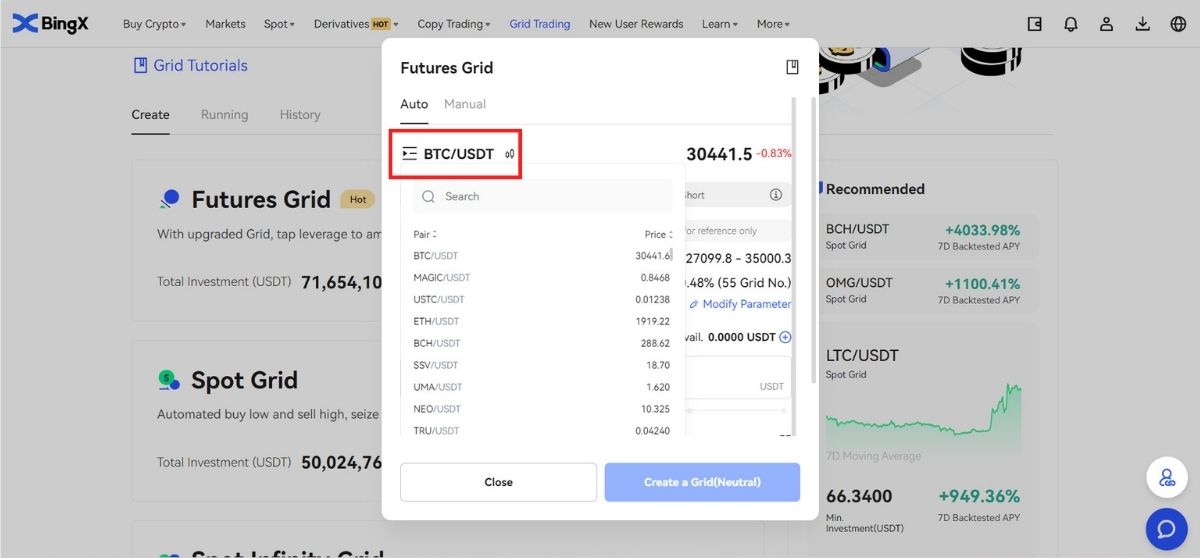

Step 3: Select a desired trading pair, such as BTC/USDT.

Step 3: Select a desired trading pair, such as BTC/USDT.

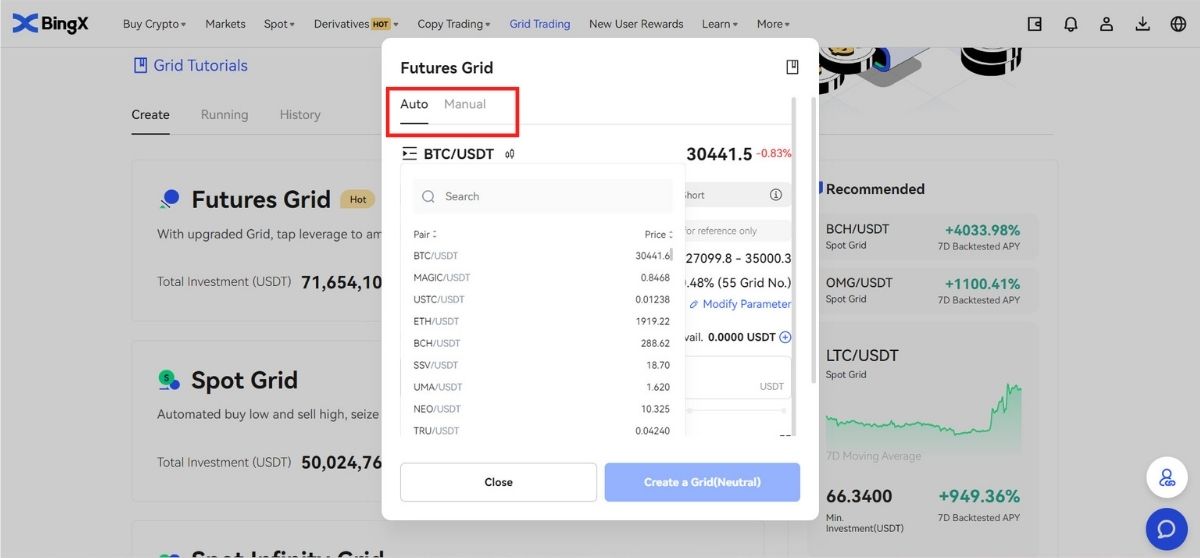

Step 4: Set up grid parameters. You can choose “Auto” or “Manual” to create a grid.

Step 4: Set up grid parameters. You can choose “Auto” or “Manual” to create a grid.

- Auto: The estimated best parameters that the system derives based on historical data and can be used directly.

- Manual: Users need to determine the price range and grid number based on their own judgment of the market volatility.

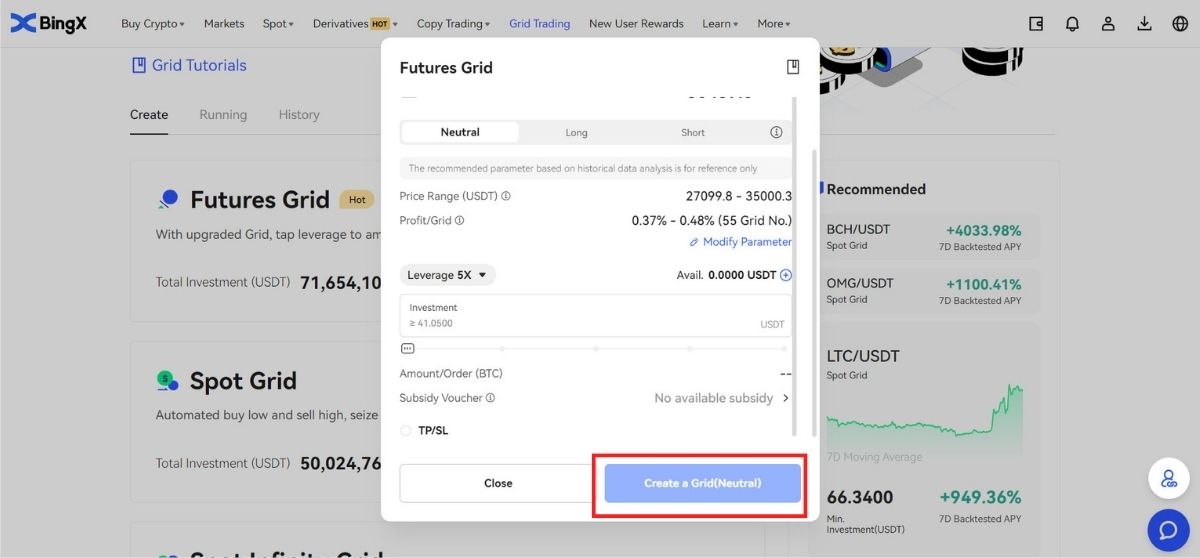

Step 5: Set up leverage and investment amount, and set the SL ratio according to your trading preference. Once the preset SL ratio is triggered, the grid strategy and positions will be closed automatically.

Step 6: Create a grid ✅

Step 6: Create a grid ✅

5. Terms

- Backtested 7D Annual Yield: The auto-filled parameters are based on the 7-day backtest data of a certain trading pair and should not be regarded as a guarantee of future return.

- Price H: The upper price limit of the grid. No orders will be placed if prices rise above the upper limit. (Price H should be higher than Price L).

- Price L: The lower price limit of the grid. No orders will be placed if prices fall under the lower limit. (The Price L should be lower than Price H).

- Grid Number: The number of price intervals that the price range is divided into.

- Total Investment: The amount users invest in the grid strategy.

- Profit per Grid (%): The profits (with trading fees deducted) made in each grid will be calculated on the basis of the parameters that users set.

- Arbitrage Profit: The difference between one sell order and one buy order.

- Unrealized PnL: The profit or loss generated in pending orders and open positions.

6. Advantages and risks of grid trading

6.1 Advantages

- 24/7 automatically buys low and sells high, without the need to monitor the market

- Uses trading bot that frees up your time while observing the trading discipline

- Requires no quantitative trading experience, friendly to beginners

- Enables position management and reduces market risks

- More flexible fund utilization

- Higher leverage, amplified profits

6.2 Risks

- If the price falls below the lower limit in the range, the system will not continue to place the order until the price returns above the lower limit in the range.

- If the price exceeds the upper limit in the range, the system will not continue to place the order until the price returns below the upper limit in the range.

- The fund utilization is not efficient. The grid strategy places an order based on the price range and grid number set by the user, if the preset grid number is extremely low and the price fluctuates between a price interval, the bot will not create any order.

- Grid strategies will stop running automatically in case of delisting, trading suspension, and other incidents.