Detailed User Manual For Bybit Exchange Features

Table of contents:

Part 1: How to Trade on Spot

Part 2: P2P on Bybit Trading: Everything You Need to Know

Part 3: Spot Margin Trading on Bybit

Part 4: Copy Trading feature on Bybit

Part 5: Trading options (Options) on Bybit

Part 6: Overview of Bybit Earn

Part 1: How to Trade on Spot

How to Place an Order for Spot Trading

For traders who are using the desktop web version, please head over to the Bybit homepage , and click on Trade → Spot Trading on the navigation bar to enter the Spot Trading page.

Select Trading Pairs

On the left side of the page you can see all trading pairs, as well as the Last Traded Price and 24-hour change percentage of the corresponding trading pairs. Use the search box to directly enter the trading pair you want to view.

Tip: Click on Add to Favorites to place frequently viewed trading pairs in the Favorites column. This feature allows you to easily select pairs for trading.

Place Your Order

Bybit Spot trading provides you with four types of orders: Limit Orders, Market Orders, Conditional Orders, and Take Profit/Stop Loss (TP/SL) Orders.

Let’s take BTC/USDT as an example to see how to place different order types.

Limit Orders

1. Click on Buy or Sell

2. Select Limit

3. Enter the order price

4. (a) Enter the quantity/value of BTC to buy/sell, or

(b) Use the percentage bar

If you want to buy BTC, and the available balance in your Spot Account is 10,000 USDT, you can (for example) choose 50% — that is, buy 5,000 USDT equivalent of BTC.

5. Click on Buy BTC or Sell BTC

6. After confirming that the entered information is correct, click on Buy BTC or Sell BTC

Your order has successfully been submitted.

Please go to Current Orders → Limit & Market Orders to view order details

Market Orders

1. Click on Buy or Sell

2. Select Market

3.(a) For Buy Orders: Enter the amount of USDT you’ve paid to buy BTC. For Sell Orders: Enter the amount of BTC you’ve sold to buy USDT.

Or:

(b) Use the percentage bar

For example, if you want to buy BTC, and the available balance in your Spot Account is 10,000 USDT, you can choose 50% to buy 5,000 USDT equivalent of BTC.

4. Click on Buy BTC or Sell BTC

5. After confirming that you’ve entered the correct information, click on Buy BTC or Sell BTC.

Your order has been filled.

You can go to Trade History to view the order details

Tip: You can view all completed orders under the Trade History.

Conditional Orders

1. Click on Buy or Sell

2. Select Conditional from the TP/SL drop-down menu

3. Enter the trigger price

4. Choose to execute at Limit Price or Market Price

- Limit Price: Enter the order price

- Market Price: No need to set the order price

5. According to different order types:

(a) Market Buy: Enter the amount of USDT you’ve paid to buy BTC

Limit Buy: Enter the amount of BTC you want to buy

Limit/Market Sell: Enter the amount of BTC you’ve sold to buy USDT

Or:

(b) Use the percentage bar

For example, if you want to buy BTC, and the available balance in your Spot Account is 10,000 USDT, you would choose 50% if you want to buy 5,000 USDT equivalent of BTC.

6. Click on Buy BTC or Sell BTC

7. After confirming that you’ve entered the correct information, click on Buy BTC or Sell BTC

Your order has been successfully submitted. Please note that no assets are being occupied until the Conditional order is successfully triggered.

Please head to Current Orders → Conditional Order to view order details

TP/SL Orders

1. Click on Buy or Sell

2. Select TP/SL from the TP/SL drop-down menu

3. Enter the trigger price

4. Choose to execute at Limit Price or Market Price

— Limit Price: Enter the order price

— Market Price: No need to set the order price

5. According to different order types:

(a) Market Buy: Enter the amount of USDT you’ve paid to buy BTC

Limit Buy: Enter the amount of BTC you want to buy

Limit/Market Sell: Enter the amount of BTC you’ve sold to buy USDT

Or:

(b) Use the percentage bar

For example, if you want to buy BTC, and the available balance in your Spot Account is 10,000 USDT, you can choose 50% to buy 5,000 USDT equivalent to BTC.

6. Click on Buy BTC or Sell BTC

7. After confirming that you’ve entered the correct information, click on Buy BTC or Sell BTC.

Your order has successfully been submitted. Please note that your asset will be occupied once your TP/SL order is placed.

Please head to Current Orders → TP/SL Order to view order details.

Note: Please make sure that you have sufficient funds in your Spot Account. If the funds are insufficient, traders who use the web can click on Deposit, Transfer, or Buy Coins under Assets to enter the asset page for deposit or transfer. For more deposit information, please refer here.

Part 2: P2P on Bybit Trading: Everything You Need to Know

Understanding Peer-to-Peer Trading

Peer-to-peer (or P2P) trading is a form of trade in which buyers and sellers directly exchange their coins and fiat assets.

What is Bybit Peer-to-Peer (P2P)?

P2P on Bybit is an easy and secure peer-to-peer trading platform. It facilitates the buying and selling of two users’ holdings at an optimal, agreed-upon price. Please note that Bybit does not provide the buy and sell offers on the P2P page.

Currently, P2P supports more than 40 fiat currencies, including EUR, USD and JPY, and also supports four cryptocurrencies (USDT, BTC, ETH and USDC).

Bybit P2P Fees Explained

The fee structure of P2P trading corresponds to two different types: taker and maker.

P2P on Bybit offers zero transaction fees for takers and makers.

| Taker Fee Rate | Maker Fee Rate | |

| All Fiat Trading Pairs | 0% | 0%* |

*Rate subject to change

Note:

— The taker is the user who buys or sells coins by placing an order through existing advertisements on the P2P platform.

— The maker is the user who posts trade advertisements.

How to Start Using P2P on Bybit

For Buyers

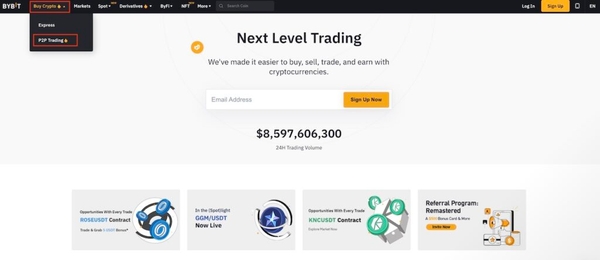

Step 1: Please click on Buy Crypto –> P2P Trading on the top left corner of the navigation bar to enter the P2P trading page.

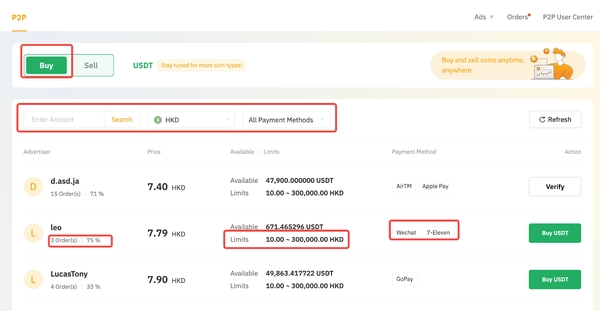

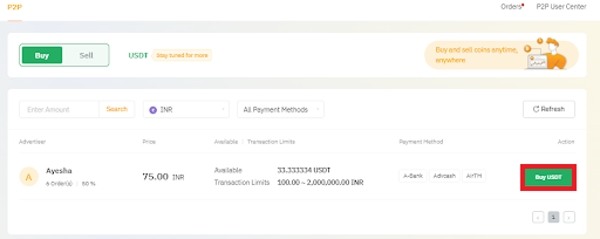

Step 2: On the Buy page, you can filter advertisers by entering your desired criteria for Amount, Fiat Currencies or Payment Methods, based on your transaction needs.

Step 3: Choose your preferred advertisement, and click on Buy USDT.

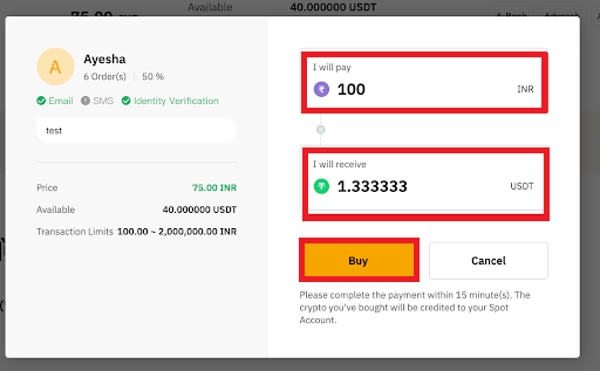

Step 4: Enter the amount of fiat you want to pay, or the amount of coins you want to receive. Click on Buy to proceed.

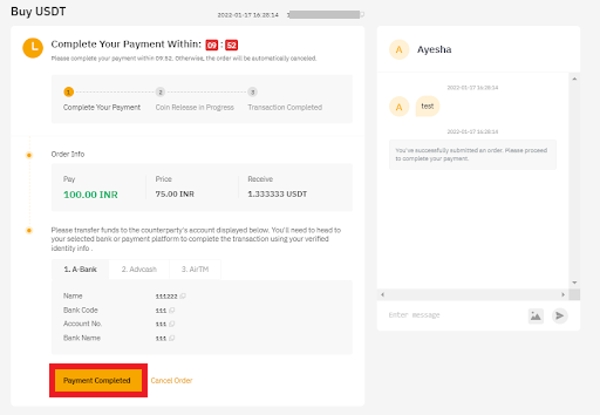

You’ll be redirected to the order page, where you’ll have 15 minutes to transfer the money to the seller’s bank account. Note: Please verify that all of the order details are correct before proceeding.

Step 5: Click on Payment Completed once you’ve completed the payment.

Step 6:

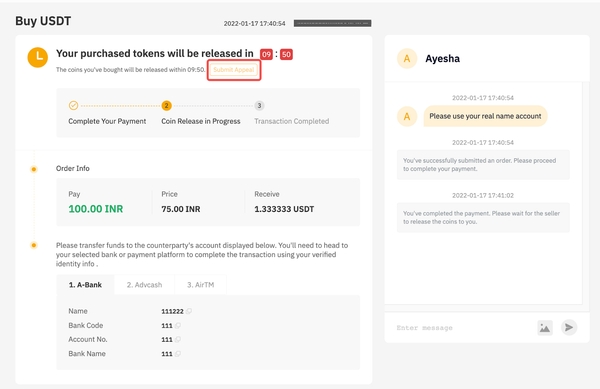

a. Once the coins you’ve purchased have been successfully released by the seller, you can click on Check Asset to view them, along with your transaction history. You can also check your order status from the P2P order history.

b. If the seller fails to release the coins after 10 minutes, you can click on Submit Appeal.

Bybit’s customer support team will reach out to you. During this period, please do not cancel the order unless you’ve received a refund from your seller.

For Sellers

Step 1: Please click on Buy Crypto –> P2P Trading on the top left corner of the navigation bar to enter the P2P trading page.

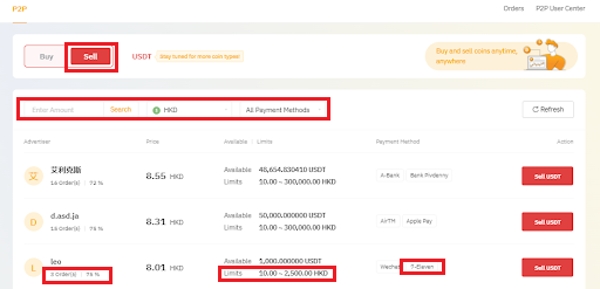

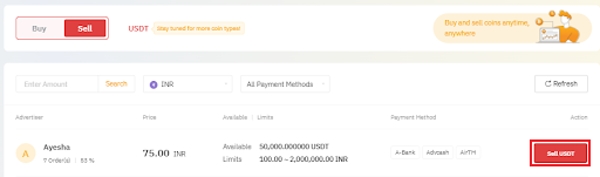

Step 2: On the Sell page, you can filter advertisers by entering your desired criteria for Amount, Fiat Currencies or Payment Methods, based on your transaction needs.

Step 3: Choose your preferred advertisement, and click on Sell USDT.

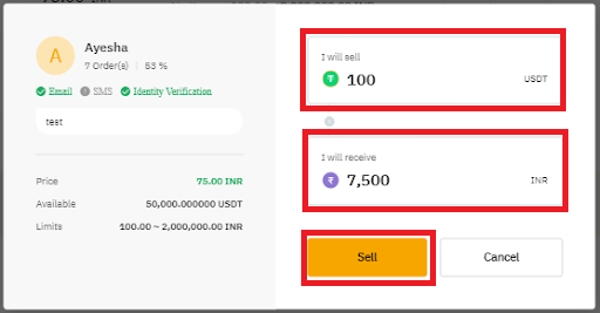

Step 4: Enter the amount of USDT you want to sell, or the amount of fiat currency you want to receive. Click on Sell to proceed.

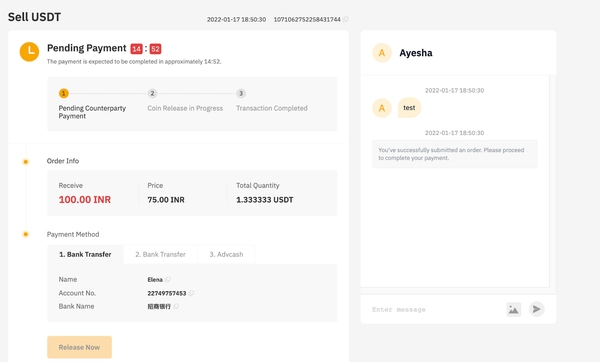

Step 5: During the pending process, the buyer will have 15 minutes to complete the payment.

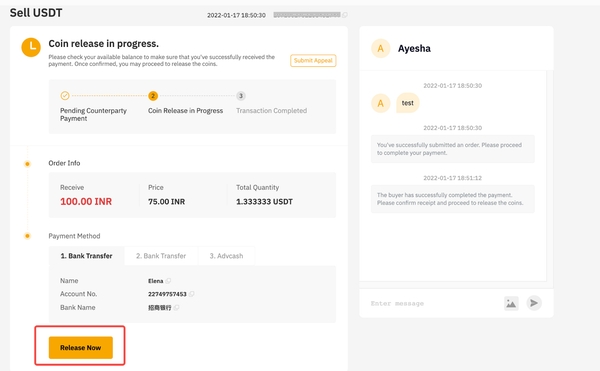

Step 6: Once you’ve successfully received your payment from the buyer, click on Release Now to release your coins. You will be asked to enter your GA verification code as a verification step.

What If the Transaction Failed?

Order transaction has failed:

1) If the buyer did not complete the payment within 15 minutes, the order will automatically be canceled. The coins reserved on the P2P platform will also automatically be returned to your Spot Account.

2) If you’re notified that the payment is completed, but have yet to receive the payment after 10 minutes, you can click on Submit Appeal. Bybit’s customer support team will reach out to you.

Part 3: Spot Margin Trading on Bybit

What is Spot Margin Trading?

Margin trading on Bybit is a Derivative product based on Spot Trading. With Margin trading, you may use assets in your Spot Account as collateral. You can use them to borrow funds from Bybit to buy and sell assets larger than your wallet balance with leverage on the Spot market.

How to Get Started With Spot Margin Trading on Bybit?

Step 1: Please click on Trade → Margin Trading on the navigation bar, and select the Spot pair you wish to trade.

Alternatively, select a Spot Pair that supports Margin trading under the list of trading pairs. You can identify the pair that support Margin Trading by the leverage icon beside.

Step 2: When using Margin trading for the first time, click on Acknowledge & Agree and you have successfully enabled Cross Margin Trading.

A Margin Trading Service Agreement pop-up box will appear. Please ensure you fully understand its information before clicking Acknowledge & Activate Margin Trading.

Step 4: You can set your parameters according to the following steps:

To turn on or off Margin trading, please head to the three dot menu on the right and click on Turn on/off Margin.

Step 5: You can now place an order in Margin mode with the following parameters:

Using BTC/USDT as an example,

1. Select your leverage: Maximum 5x.

Notes: Only users who upgraded to Unified Trading Account can select their leverage multiplier, other users can only use the default 5x leverage.

2. Select your trade direction: Long or Short

3. Select order type: Limit, Market or Conditional

4. Enter the order price or Trigger Price (only available for Limit and Conditional orders)

5. (a) Enter the quantity, or

(b) Use the percentage bar to quickly adjust the order value of your order.

6. Click on Buy/Long BTC or Sell/Short BTC.

(UTA users) (Non-UTA users)

You can refer to the Amount to Borrow and the system will borrow the required funds on your behalf to place the order.

Here’s a tip:

Before confirming your order, make sure you understand the following two terms:

- Available Balance = Available Balance (Spot Account) + the Max. Borrowable Amount.

- Amount To Borrow = min(Order quantity, Available Balance) – Available Balance (excluding borrow limit)

Notes:

— All repayments will be made in the type of coin you borrowed.

— When LTV ≥95%, the liquidation will be triggered and a 2% liquidation fee will be charged.

Turn off Margin trading

You can disable Margin trading at any time by selecting Turn off Margin on the Spot Trading page or Assets page.

In addition, you can also select Spot directly to switch back to Spot trading.

Please note that you must complete all repayments before turning off Margin trading.

Part 4: Copy Trading feature on Bybit

What is Copy Trading?

How To Copy Trades On Bybit Support You:

Main Trader:

As a Master Trader, you will have to build a follower base, engage with a global network of users and earn rewards – like 11%* of your followers’ net profit.

Followers:

As a Follower, you will have access to a large network of successful Master Traders, copy their trades automatically and monitor the P&L in real-time.

How to Start Copy Trading:

Step 1: Sign up. You can register as a Master Trader or a Follower.

Step 2: Submit the application form. Wait for your application to be approved, usually 2–5 days.

Step 3: Start copying trades. Master Trader: Start trading and your trades will be automatically shared.

Followers: Select a Master Trader to follow and copy trades.

Why Start Copy Trading?

- Transparency: All trades, profits and losses are highlighted, ensuring you have everything you need to make the right choice.

- Automatic: When you join as a Follower and select a Master Trader to follow, copying and execution of trades happens automatically.

- Low Barrier to Join: As a Follower, you just need to deposit and be ready to join!

- Reliable: All of our Master Traders are rigorously tested to ensure outstanding performance and stable income.

Part 5: How to Get Started with Options Trading on Bybit

Before you start to trade USDC options, please ensure that you have transferred USDC to your USDC account.

Step 1: Click on Assets at the top right-hand corner of the Bybit home page. Then click USDC Derivatives.

Step 2: Next, click Transfer In

Step 3: On the Transfer page, in addition to USDC, you can convert the USDT in your Spot Account into USDC at the real-time exchange rate, and transfer directly to your USDC Account.

Here’s a step-by-step guide to help you place your first Options order on Bybit.

Step 1: Click on Derivatives –> USDC Options on the navigation bar to enter the USDC Options trading page.

The USDC Options trading page consists of two main sections:

a. Summary tabs: View details about your option trades, including Position Summary, Expiration Date, Greeks, Position, Active Order, Order History and Trade History.

Tip: Bid and ask columns display the prices at which market participants are willing to buy or sell options contracts.

Step 2: Select an expiration date you’re interested in, or you can display all the expiration dates at once — the expiration date of the option you intend to buy or sell — from the dates listed at the top of the options chain.

Step 3: Select option type: Calls or Puts.

You can view Call Options displayed on the left side of the options chain, and Put Options on the right. The Strike Price is displayed in the middle.

Step 4: Click on the desired Strike Price on the left side (Calls) or right side (Puts) of the option chain, and the order placement window will appear on the right side of the trading page.

Step 5: In the order placement window, you’ll be able to view the details of the options: Implied Volatility (IV), Delta, Gamma, and more.

Next, you can enter order parameters to place your options order.

Set via Limit

a. Select your trade direction: Buy or Sell

b. Enter the order price

c. Enter the quantity to buy or sell

d. Select Post-Only (optional)

e. Select your Time in Force strategies (optional)

Set via IV

a. Select your trade direction: Buy or Sell

b. Enter the amount of IV

c. Enter the quantity to buy or sell

d. Select Post-Only (optional)

e. Select your Time in Force strategies (optional)

Step 6: After you have entered the price/IV and quantity, you may see the margin required for the trade and the options greeks calculated for you. You may also view the P&L probability chart below the order placement area for the expected profitability of the options order.

Set via Market

a. Select your trade direction: Buy or Sell

b. Enter the quantity to buy or sell

c. Select Reduce Only (optional)

For market orders, margin required will not be shown as market orders as the price will only be known after the order is executed.

Step 7: Click on Place Order to bring up a confirmation window.

Step 8: Confirm that all the information you’ve entered is accurate and click on Confirm.

Your options order has been submitted successfully.

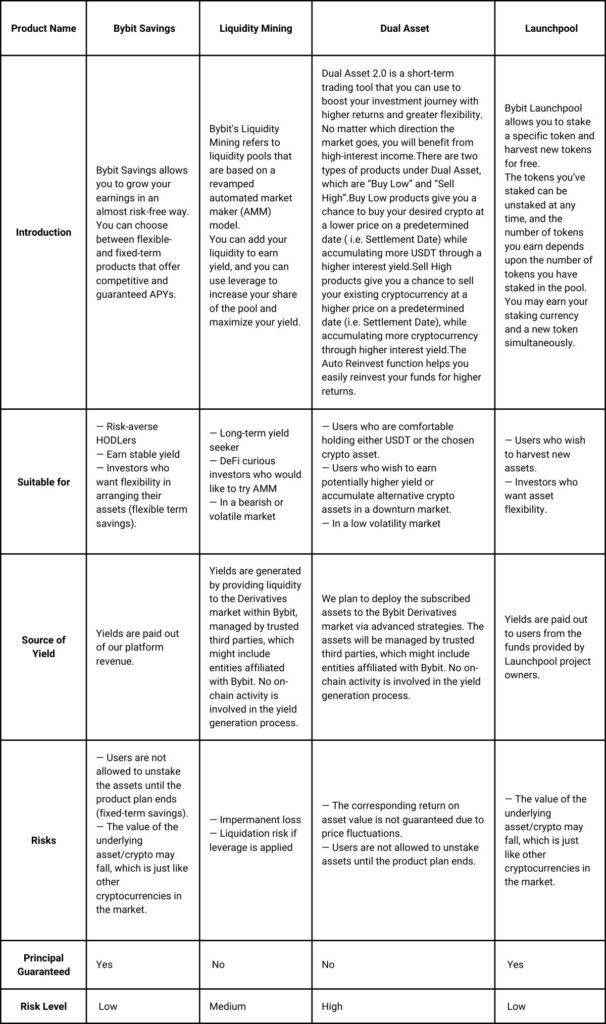

Part 6: Overview of Bybit Earn

What is Bybit Earn?

Bybit Earn is a management platform that helps crypto investors control and expand their assets. The product aims for competitive yields and top-notch security, making them perfect for both beginners and seasoned investors.

Bybit Earn contains several secondary products within its offerings. Some of these products are geared toward risk-averse investors, while others are designed to offer higher yields. Whatever your preferences and inclinations as a trader, you’re sure to find a Bybit Earn product that’s right for you. This versatility makes Bybit Earn one of the best ways to earn crypto.

Let’s look at the differences between each Bybit Earn product so you can choose the one that best suits your investment style.